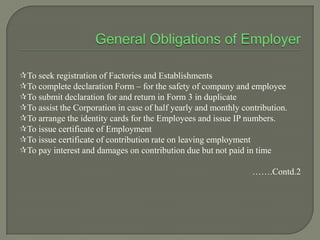

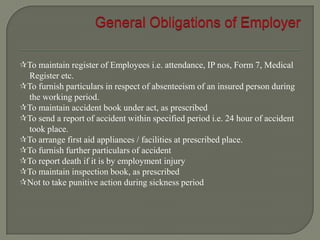

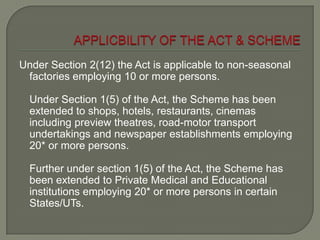

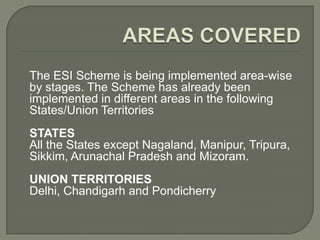

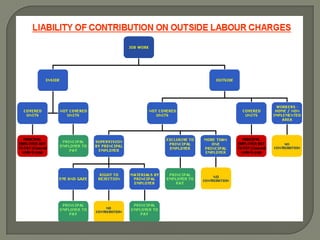

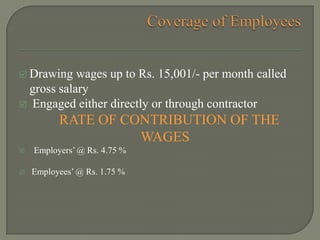

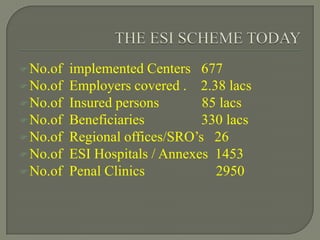

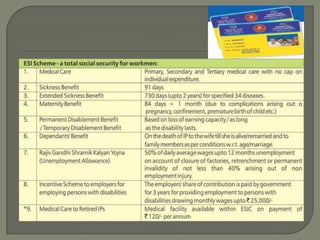

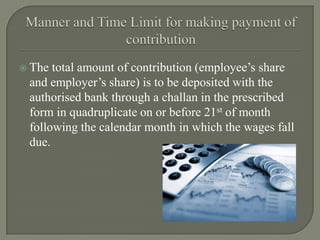

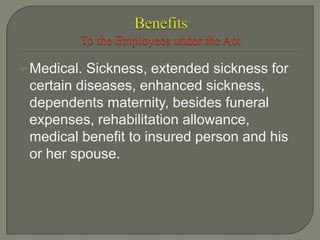

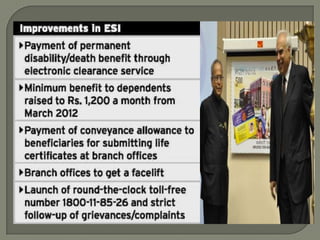

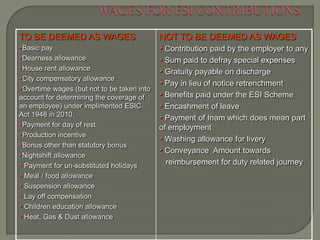

This document outlines the responsibilities and procedures for employers regarding the Employees' State Insurance (ESI) scheme in India. It details requirements such as registering factories and establishments, completing declaration forms, submitting returns, assisting with contributions, maintaining employee records, reporting accidents, and more. It also provides information on ESI scheme coverage, contribution rates, available benefits including medical care and maternity benefits, and penalties for non-compliance.