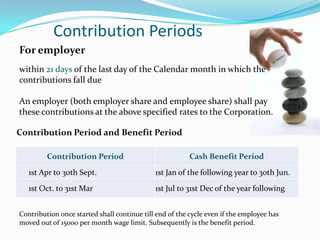

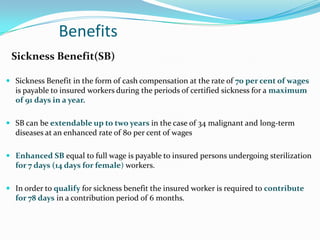

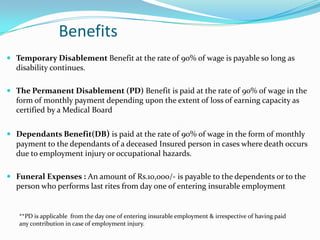

The document outlines the Employees' State Insurance (Central) Rules, 1950 which provides medical, sickness, maternity and other benefits to employees in India. [1] It is applicable to factories/establishments with 10 or more employees in certain states. [2] Both employers and employees must contribute monthly amounts that are 1.75% and 4.75% of wages, respectively, to receive benefits like free medical care, cash compensation for sickness/disability, maternity benefits and unemployment allowance. [3]