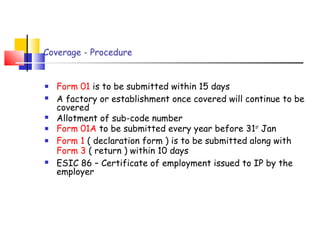

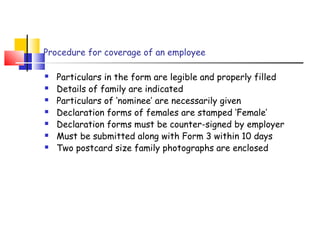

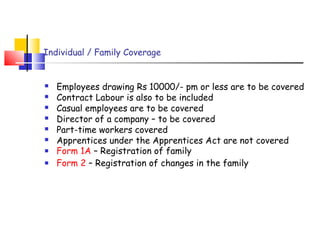

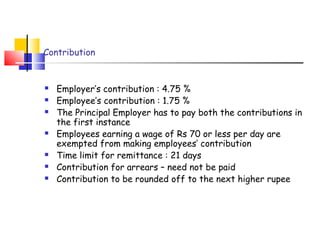

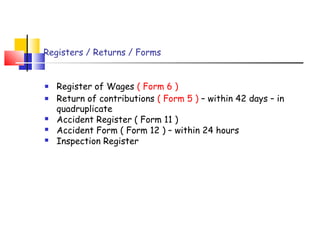

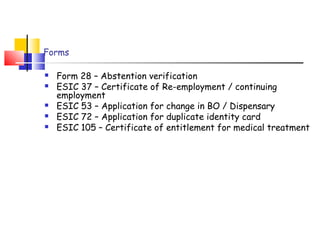

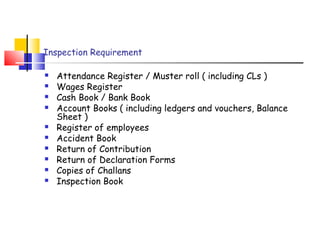

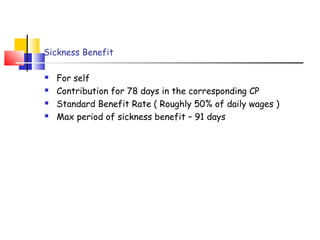

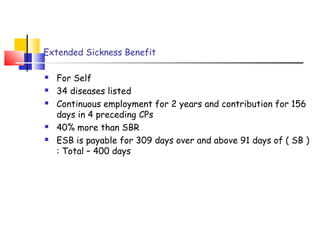

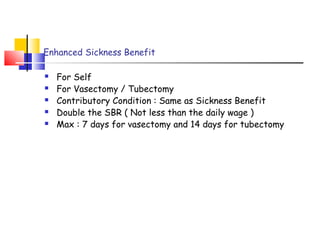

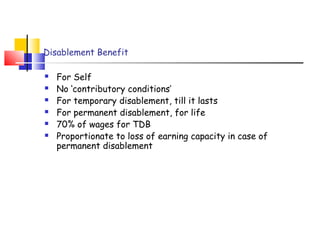

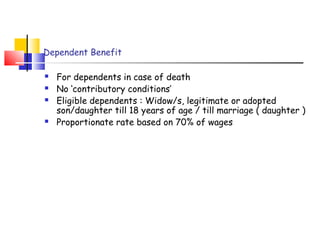

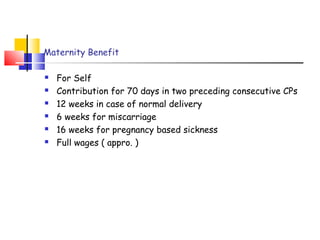

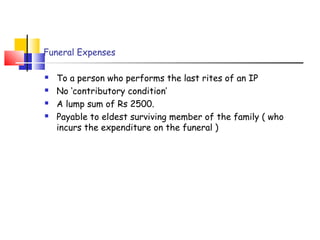

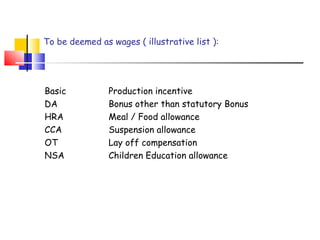

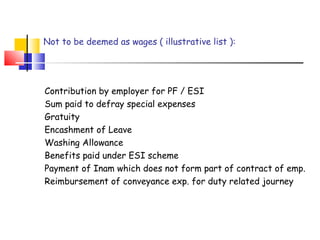

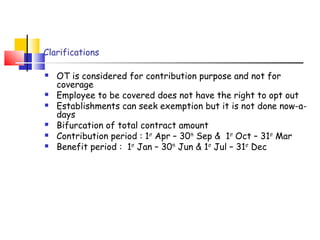

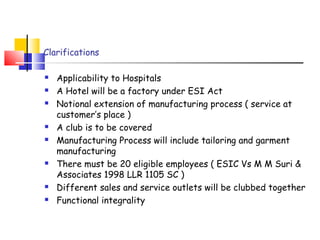

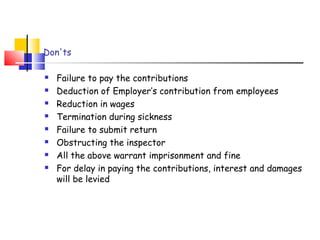

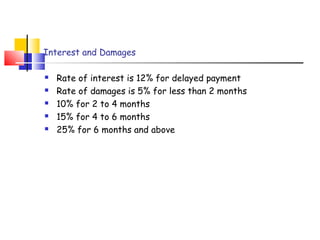

This document summarizes the key aspects of the Employees' State Insurance Act, 1948 in India. It outlines the applicability of the Act to factories and establishments based on employee count. It describes the advantages for employers in being exempted from other acts. It explains the procedures for employee and family coverage, contributions by employers and employees, benefits provided like sickness, maternity, disablement benefits and more. It also describes registers, returns and forms to be maintained and penalties for non-compliance.