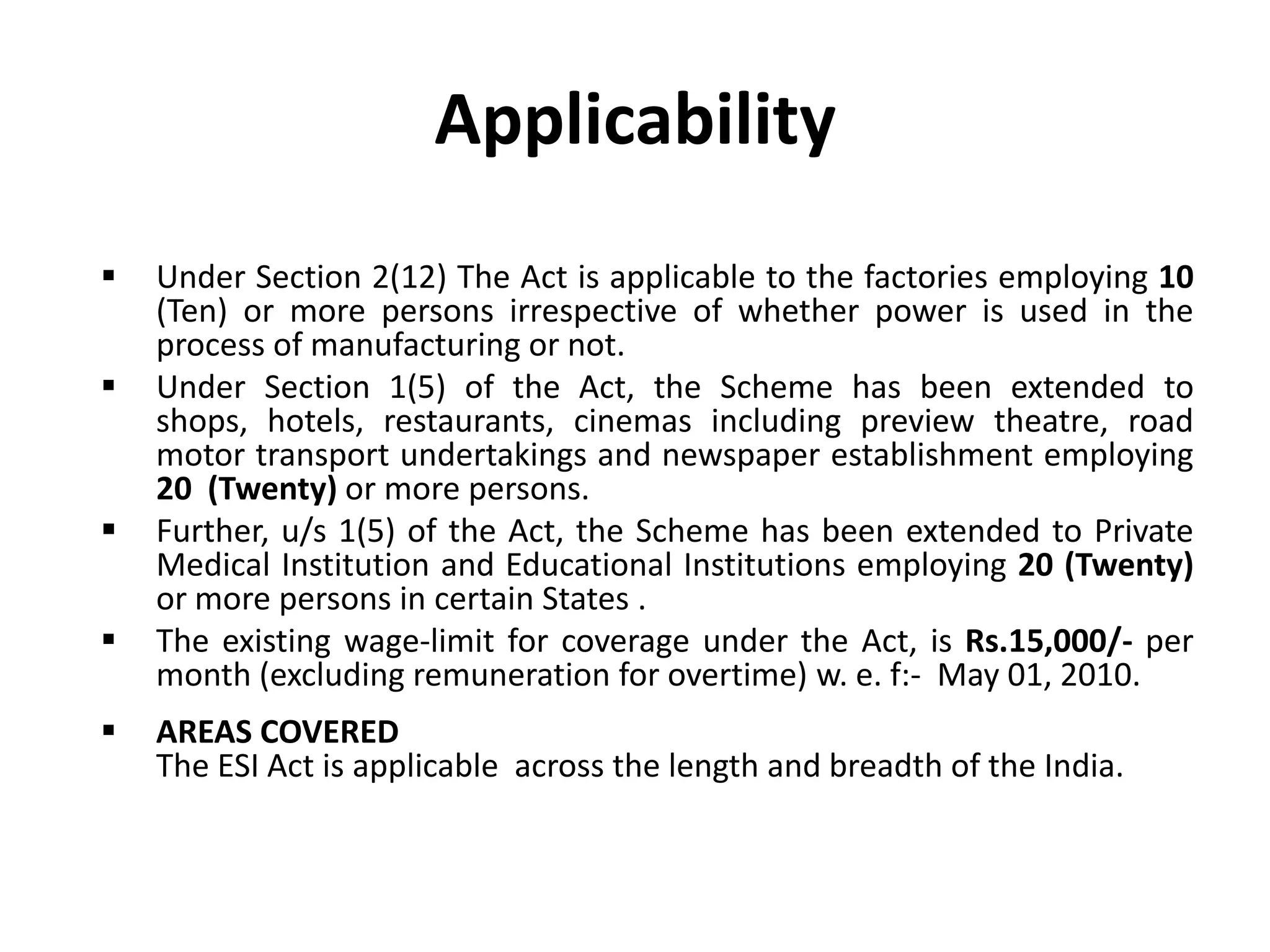

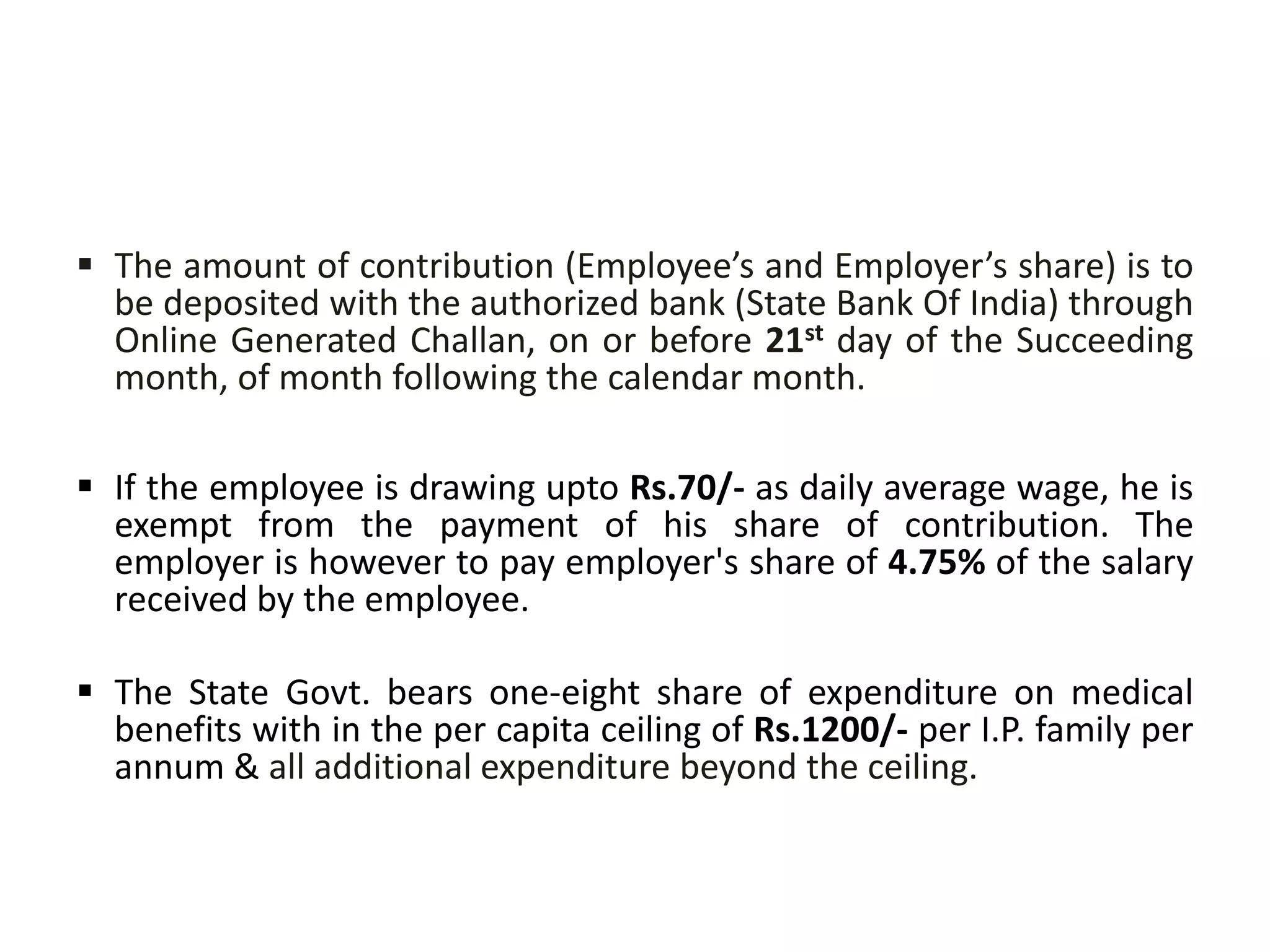

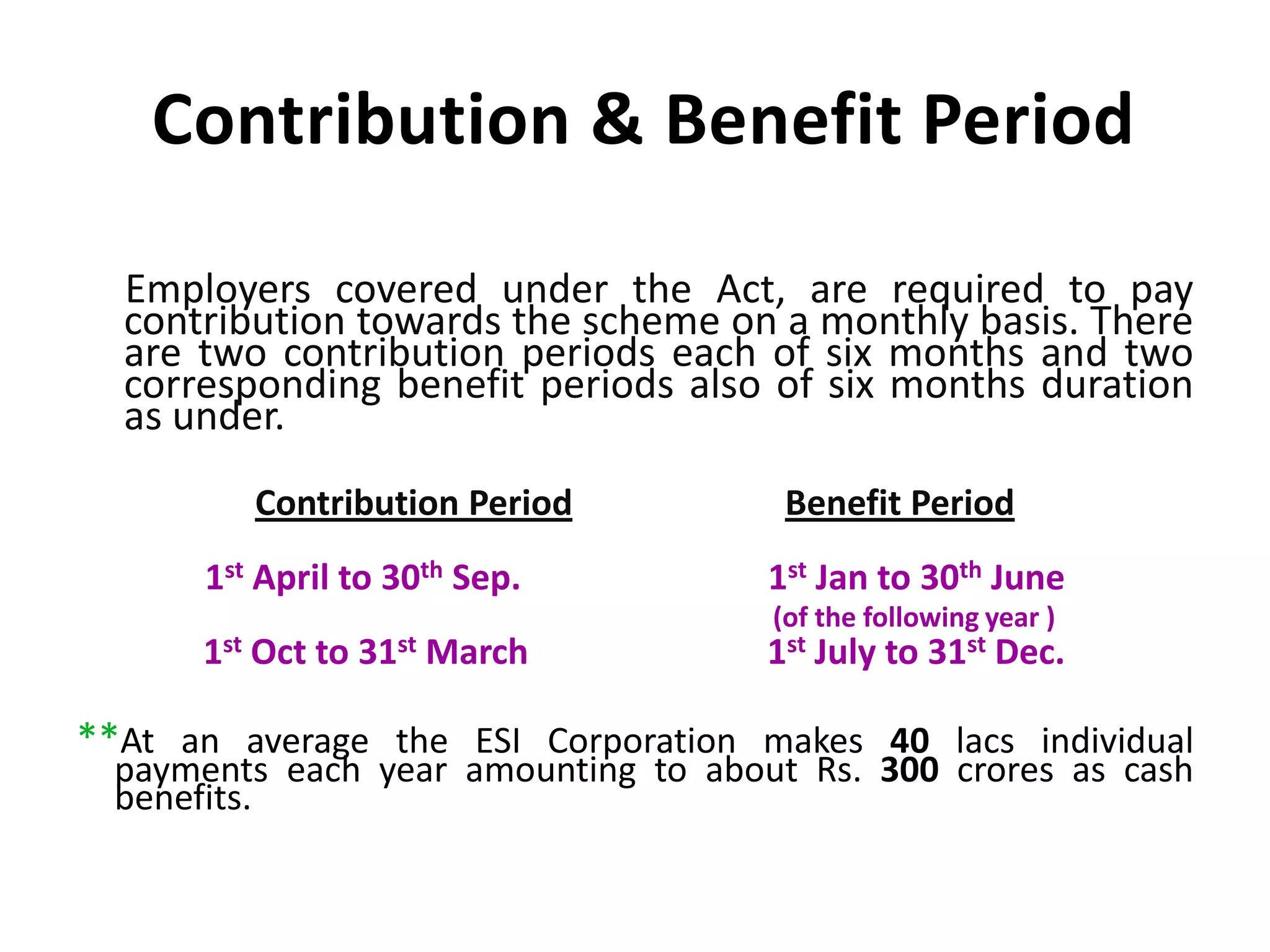

The document summarizes the Employee State Insurance Scheme (ESIS) in India. The ESIS is a self-financing social security and health insurance scheme for Indian workers. It provides sickness, maternity, disability and death benefits to insured employees and their dependents. The scheme is funded by contributions from both employers (4.75% of wages) and employees (1.75% of wages). The ESIS applies to firms with 10 or more employees in most industries and provides medical care and cash benefits to insured persons.