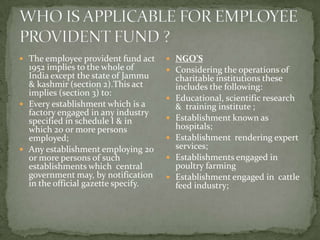

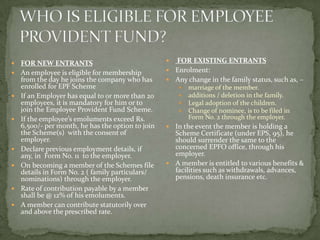

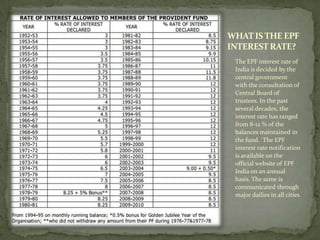

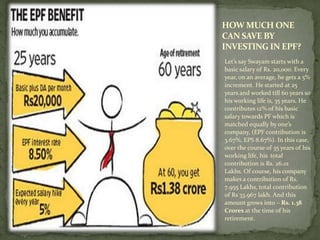

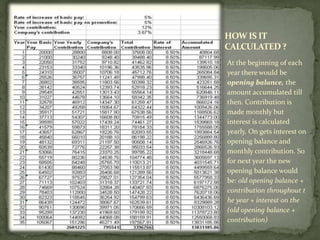

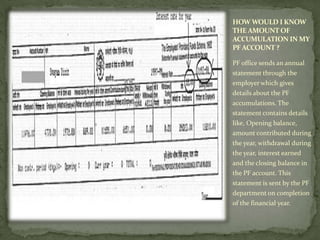

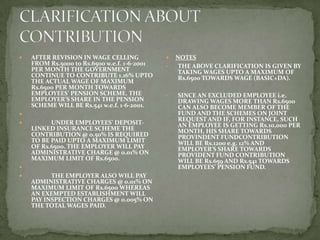

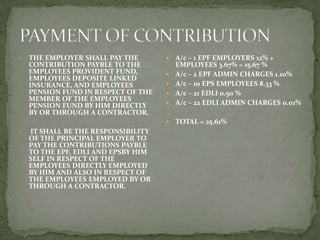

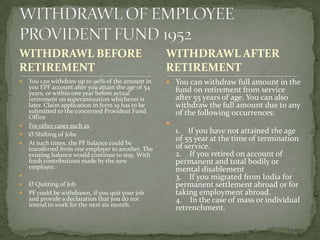

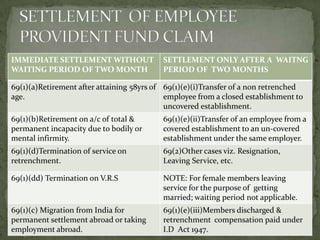

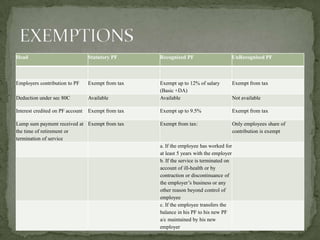

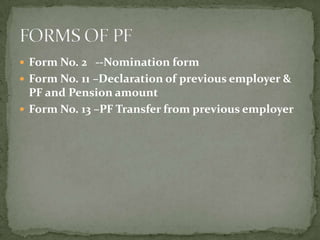

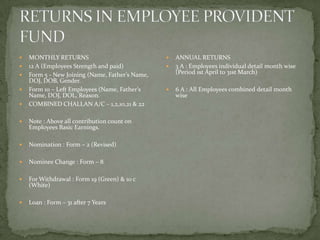

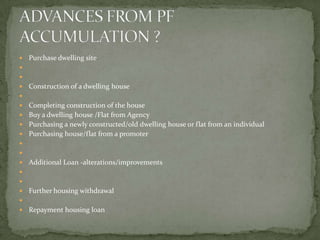

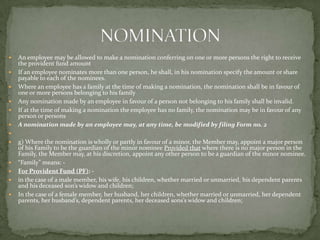

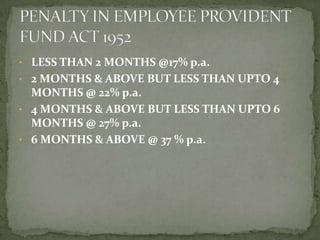

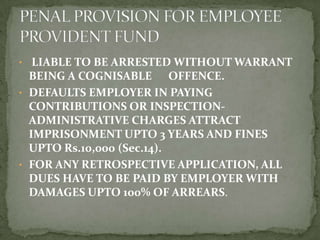

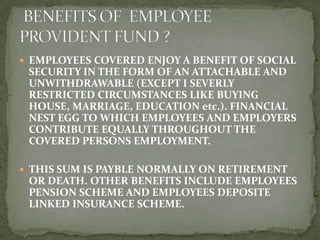

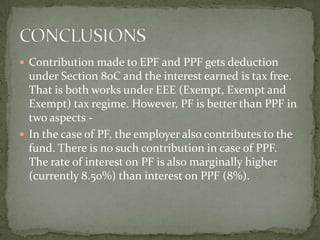

The document outlines the key aspects of the Employee Provident Fund (EPF) scheme in India, including eligibility, contributions from employers and employees, investment patterns, withdrawal procedures, settlements on retirement or termination, exemptions from tax, and benefits. EPF is a mandatory savings program for employees in India that provides tax-deferred savings and a lump sum payment on retirement. Non-compliance by employers can result in penalties like fines and imprisonment.