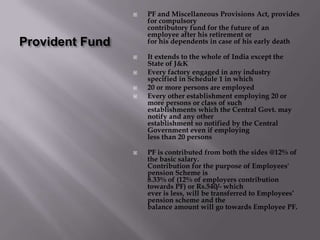

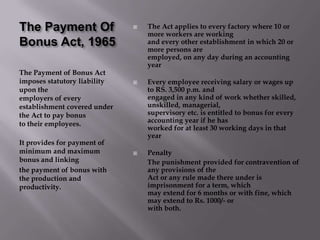

This document discusses various Indian labor laws and statutory compliance requirements for human resource management. It outlines key provisions of laws related to provident fund, employee state insurance, professional tax, gratuity, minimum wages, maternity benefits, bonus payments, and payment of wages. Compliance with these statutes is important to safeguard employees and the organization from risks and penalties for non-compliance. Failure to adhere to the various labor laws could result in fines or imprisonment for the employer.