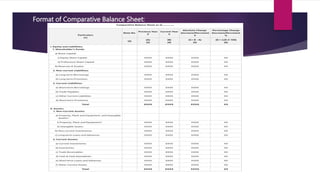

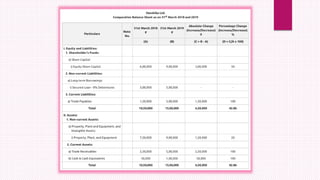

The document provides information on comparative balance sheets, including:

- A comparative balance sheet compares balance sheet items like assets, liabilities, and equity for two or more periods to analyze changes.

- It aims to analyze increases or decreases in rupees and percentage for each item, and determine reasons for any financial position changes.

- Preparing a comparative balance sheet highlights trends, emphasizes changes rather than just a single period status, and links the balance sheet to the profit and loss statement by showing the effects of operations on financial position.