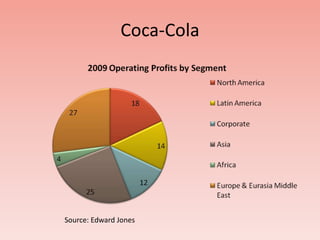

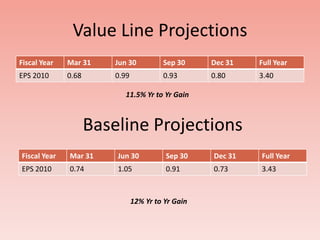

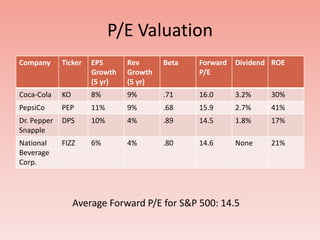

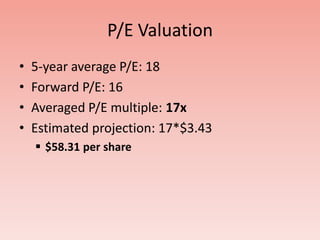

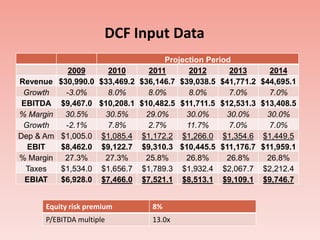

This document provides an overview and analysis of Coca-Cola Company through a SWOT analysis. Some of Coca-Cola's strengths include being the world's leading brand in the beverage industry with strong brand recognition globally. It also has a large scale of operations with products sold in over 200 countries. However, weaknesses include negative publicity from lawsuits and controversies over health issues. The document also provides financial projections for revenue and earnings per share through 2014 and evaluates Coca-Cola's stock valuation using P/E multiples and a discounted cash flow model.