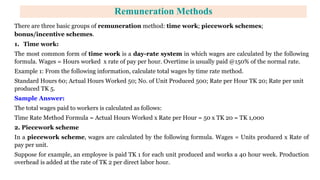

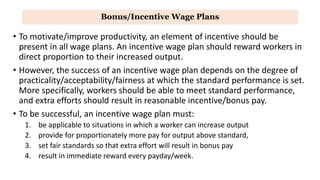

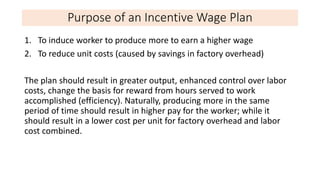

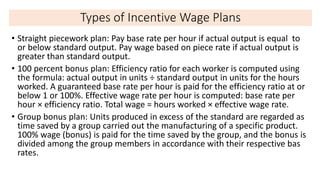

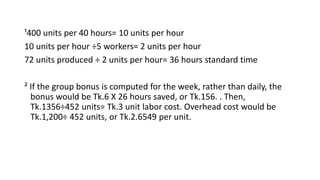

Labor cost is an important factor that requires constant measurement and analysis. It consists of basic pay and fringe benefits like holidays, vacations, overtime pay, pensions, and cost of living adjustments. Labor productivity compares output to hours worked and can be improved by better workforce utilization, processes, equipment, and compensation methods. There are three remuneration methods: time work based on hourly rates; piecework based on units produced; and bonus/incentive schemes that reward higher output. Incentive plans aim to increase productivity and reduce costs by basing pay on work accomplished rather than hours served.

![3.c. A worker is paid Tk. 8,000 per month in addition to dearness allowance of Tk.800 per month. He is

entitled to bonus @ 10% on wages. Employer’s contribution is 8% of wages towards contributory provident

fund to which workers also contributes an equal amount. The contribution for social security tax is 1% for

both employer and worker. The employer maintains a canteen where subsidized tea and lunch are provided

to workers and monthlysubsidy of Tk. 40,000 is provided to the canteen. The total number of employees who

takeadvantage of the canteen is 400. Normal idle time amounts to 20%. The worker is entitled to 15 days’

earned leave during the year. The number of working days in a year should betaken to be 300 of 8 hours

each.

Required: Find out the labor cost per hour. [June 2021, 2016]

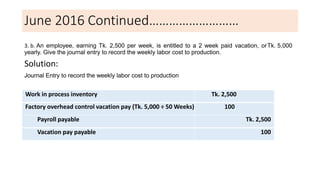

Solution: Total labor cost per month :

(1) Wages Tk. 8,000

(2) Dearness allowance 800

(3) Bonus @ 10% on wages (8000 x 10%) = 800

(4) Employer’s contribution to CPF @ 8% of wages = (8000 x 8%)= 640

(5) Employer’s contribution to social security tax @ 1% of wages = 80

(6) Proportion of canteen subsidy (Tk. 40,000 / 400) 100

Total labor cost per month for a worker Tk. 10,420](https://image.slidesharecdn.com/coab2-220830080422-572bf893/85/COA-B2-pptx-13-320.jpg)

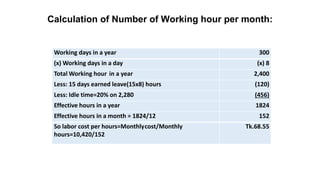

![June 2016

3. a. Assume that Mr. Abu Baker, an assembler of a factory, worked a total of 45 hours in a single week

on job #453. Mr. Baker’s weekly rate of pay is Tk.48 per hour for any hours worked up to 36 hours as per

his union contract, and Tk. 72 per hour for any hours worked in excess of 36 hours per week.

Required:

Calculate Mr. Baker’s total wages for the week and Give journal entries to record Mr. Baker’stotal

wages for the week assuming that:

i. the overtime premium was due to random job scheduling

ii. the overtime results from the requirements of a specific job and not from randomscheduling

iii. the overtime resulted from negligence or poor workmanship on the part of Mr. Baker.

Solution:

Mr. Abu Baker’s total wages for the week are computed ad follows:

OR

Regular Pay (45 hours x Tk. 48) = Tk. 2,160

Overtime premium [(45-36) hr x (Tk. 72 – 48)] = 216

Tk. 2,376

Normal Hours payment = (36 hrs x Tk. 48) = 1728

Over time payment 9 hrs x Tk. 72 = 648

2376](https://image.slidesharecdn.com/coab2-220830080422-572bf893/85/COA-B2-pptx-15-320.jpg)