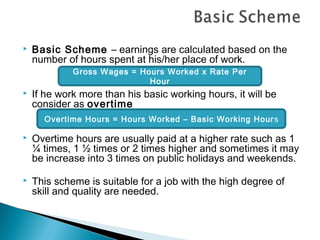

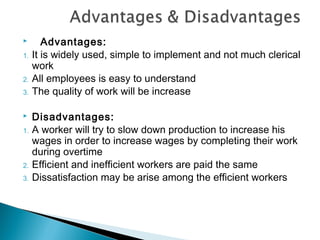

The document discusses various aspects of direct and indirect labor costs. It defines direct labor as costs that can be traced directly to a specific product or service, like cooks in a restaurant. Indirect labor supports the organization generally, like cleaners. It also discusses methods for tracking labor time, like punch cards and time sheets, and different payment schemes, such as piece rates where workers are paid per item produced. The goal is to match employees to the right jobs, compensate them fairly, and motivate good performance.