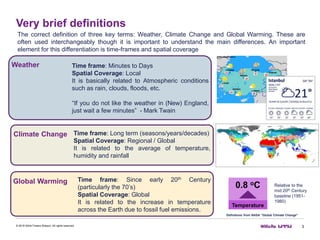

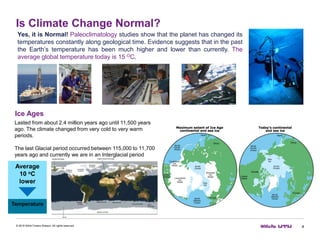

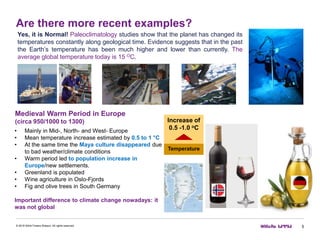

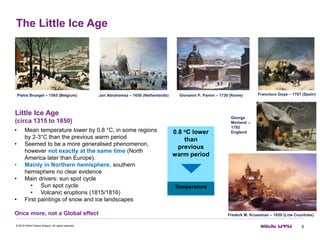

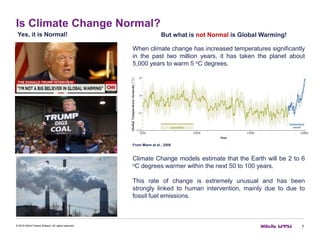

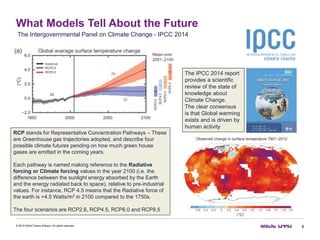

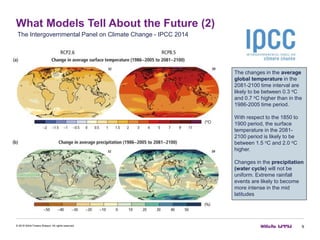

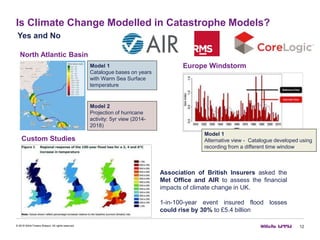

This document summarizes an insurance conference on climate change. It begins with an agenda covering general topics on climate change effects, (re)insurance implications, and catastrophe modeling. It then defines key terms like weather, climate change, and global warming. The document discusses how climate change has occurred naturally in the past through ice ages and warmer periods. It outlines projections from climate change models on expected temperature increases. Finally, it discusses how the insurance industry can help address climate change through practices like risk-based pricing and investing in risk mitigation.