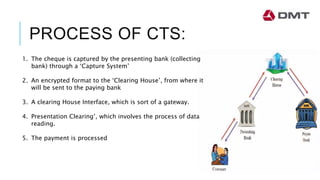

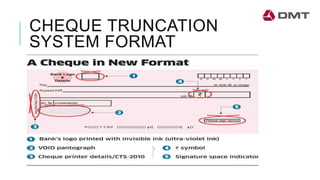

The Cheque Truncation System (CTS), initiated by the Reserve Bank of India in 2010, enhances the efficiency of cheque clearing by eliminating physical cheque transfers, reducing the process time from 3-4 days to about 1 day. The system uses digital capture and electronic processing, benefiting customers with faster credits and reducing risks for banks by minimizing errors and costs. Legal considerations include compliance with the Negotiable Instrument Act and ensuring the authenticity of cheques and signatures.