This document provides an overview of various banking products and services. It begins by defining banking as accepting deposits from the public that are repayable on demand. It then discusses the key roles of banks as financial intermediaries, constituents of the payment system, and providers of financial services. The document goes on to describe various deposit, lending, and payment products offered by banks, including accounts, loans, cards, funds transfer services, and collection services. It provides details on the types of personal and business credit as well as working capital facilities available.

![Roles of Banks [Contd.]

Payment system

Pay deposits on demand

Payment through cheques

Facilitate movement of money

Circulatory system of the economy

Financial services provider

Products of mutual funds and insurance

companies

Collection of utility bills, etc.

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-5-320.jpg)

![Payment Services [Contd.]

In this section you will learn that

Some other products offered as part of

the payment service are

○ Debit card

○ Credit card

○ Travel card

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-17-320.jpg)

![ECS [Contd.]

Benefits

Speed

Accuracy

Secured channel

Avoids manual intervention (processing

of transactions)

Saves time due to systemic handling

Benefits flow to bank, customer and user

public

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-27-320.jpg)

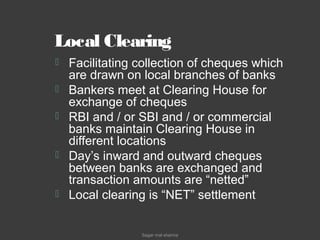

![Collection Services

[Contd.]

In this section you will learn that

Some more of the products offered as a part of the

collection service are

○ Cheque Collection

○ National Clearing

○ Cash Management Service (CMS)

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-29-320.jpg)

![Collection Services

[Contd.]

In this section you will learn that

Some further products offered as a part

of the collection service are

○ Bill Collection

○ Foreign Exchange

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-34-320.jpg)

![Foreign Exchange [Forex]

Need arises when payments are to be

made to a beneficiary in an overseas

country in foreign currency

Payments received in foreign currency

needs to be realised in Indian currency

Banks maintain accounts in an overseas

country to facilitate transactions

involving foreign currency

Such accounts are known as “Nostro”

accounts

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-36-320.jpg)

![Deposit & Credit Services

[Contd.]

In this section you will be able to

Identify various products offered as

business credit

Sagar mal sharma](https://image.slidesharecdn.com/presentationonbanking-150525053303-lva1-app6892/85/Presentation-on-banking-45-320.jpg)