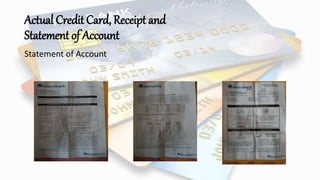

The document discusses the history and use of credit cards. It begins with definitions of credit cards as small plastic cards that allow the holder to make purchases and pay later. It then discusses the early history of credit and debt instruments dating back thousands of years, followed by the introduction of proprietary cards by US department stores in the early 1900s. The document provides guidance on responsible credit card use including paying balances off monthly to avoid interest, and covers the basic benefits of using credit cards.