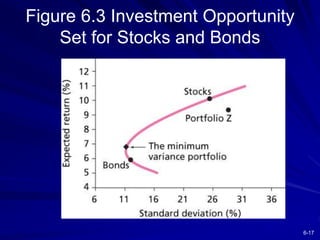

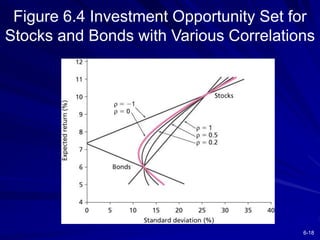

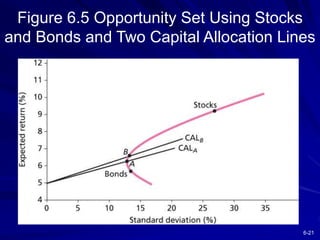

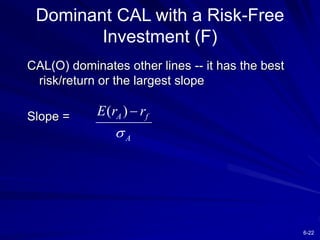

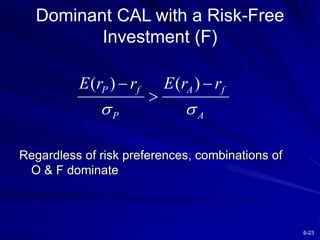

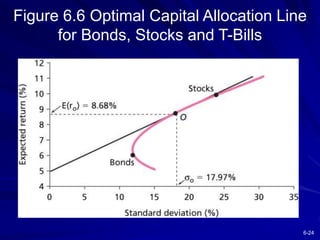

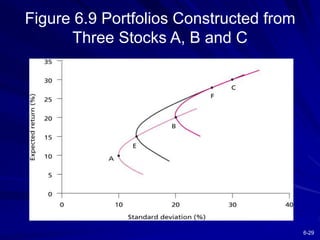

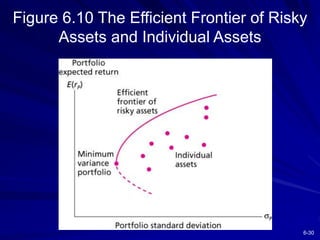

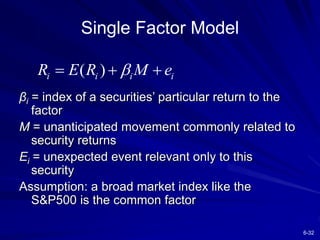

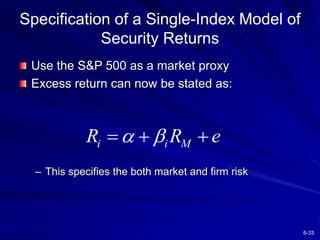

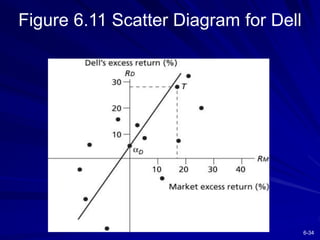

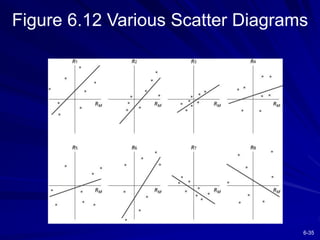

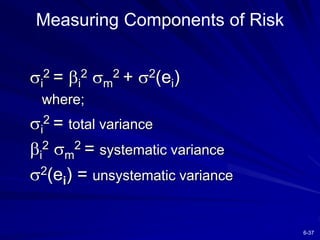

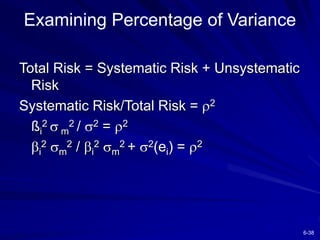

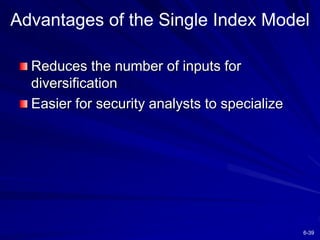

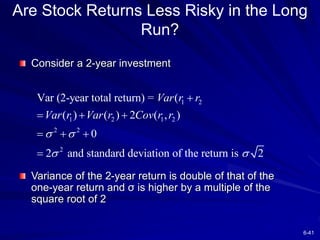

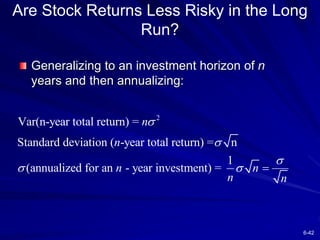

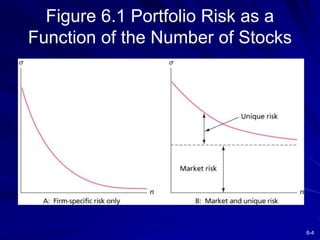

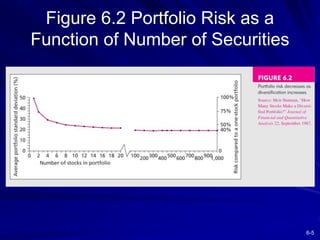

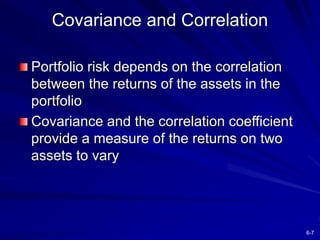

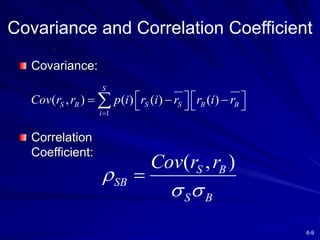

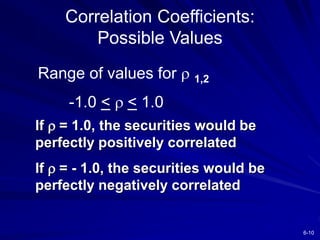

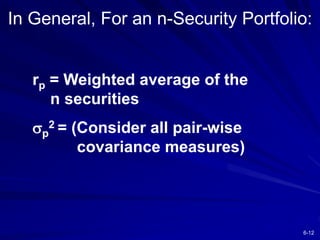

This chapter discusses diversification and portfolio risk. It explains how diversifying across multiple stocks or assets reduces unsystematic risk. The chapter introduces concepts like correlation and covariance that measure how asset returns relate to one another. It shows how optimal portfolios can be created by combining risky assets with a risk-free asset. These portfolios form an efficient frontier that offers the highest expected return for a given level of risk. A single-factor asset pricing model is presented that breaks down risk into systematic and unsystematic components. Finally, the chapter addresses whether risk is reduced when considering long-term stock investments.

![6-16

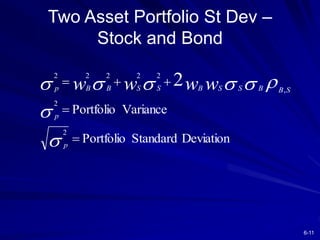

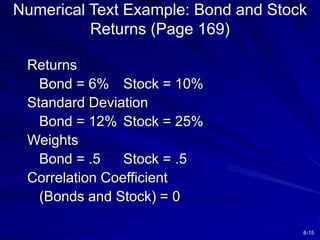

Numerical Text Example: Bond and Stock

Returns (Page 169)

Return = 8%

.5(6) + .5 (10)

Standard Deviation = 13.87%

[(.5)2 (12)2 + (.5)2 (25)2 + …

2 (.5) (.5) (12) (25) (0)] ½

[192.25] ½ = 13.87](https://image.slidesharecdn.com/chapter006-230131063747-5b855710/85/Chapter_006-ppt-16-320.jpg)