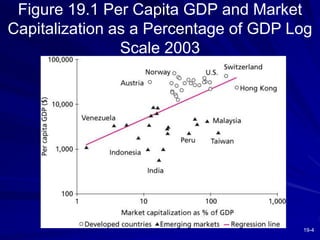

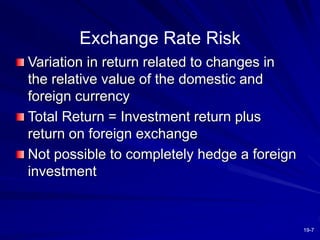

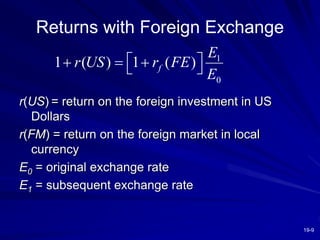

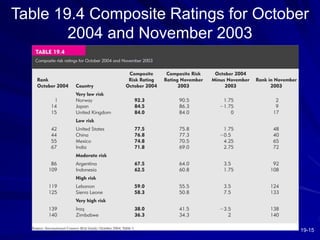

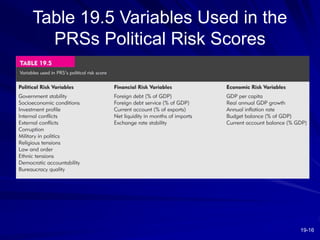

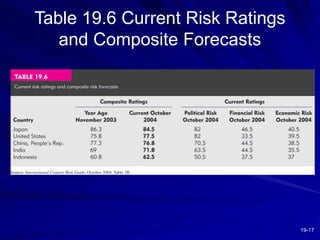

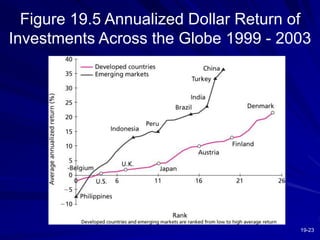

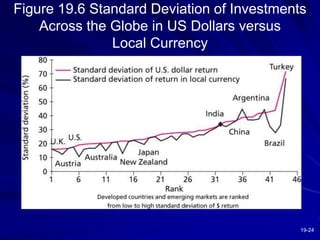

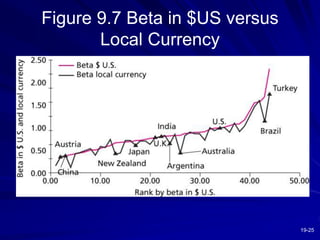

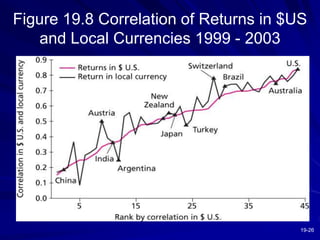

1) The document discusses the risks, returns, and benefits of international investing in equities markets. It examines factors like exchange rate risk, country-specific risks, and the potential for diversification.

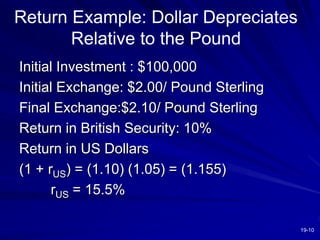

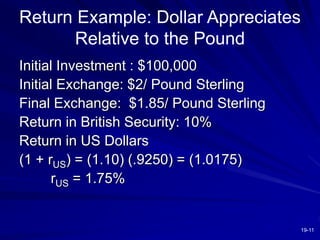

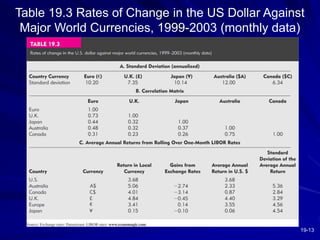

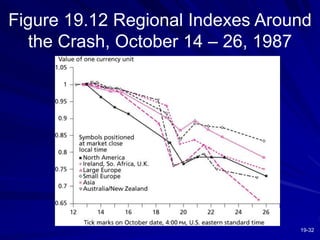

2) Several charts and examples are provided showing how exchange rate fluctuations can impact returns on foreign investments in both positive and negative ways.

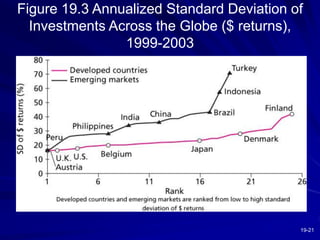

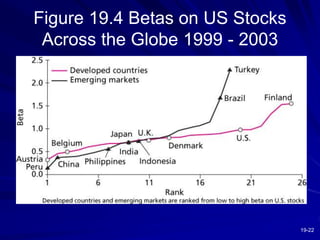

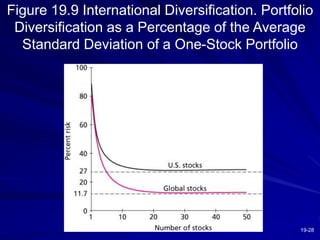

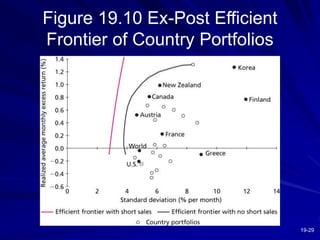

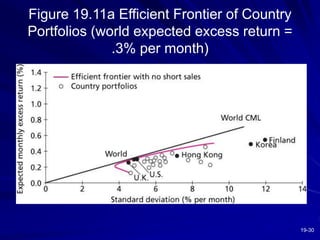

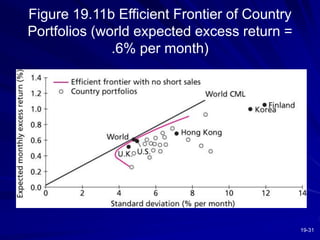

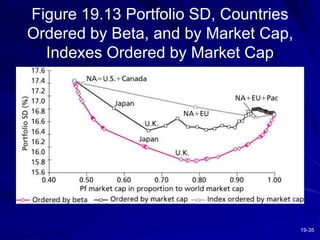

3) Evidence suggests that international diversification can expand an efficient frontier and reduce systematic risk compared to a domestic-only portfolio, demonstrating potential benefits.