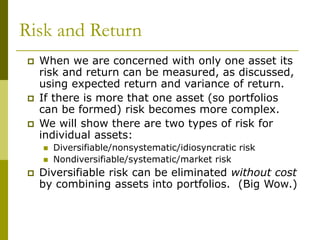

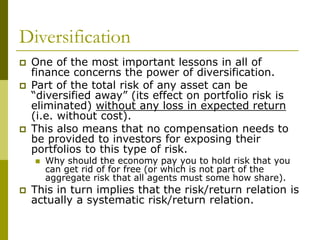

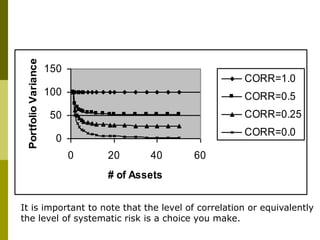

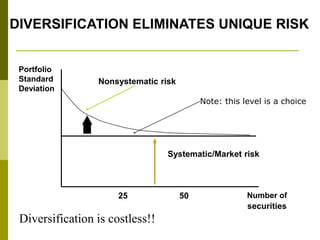

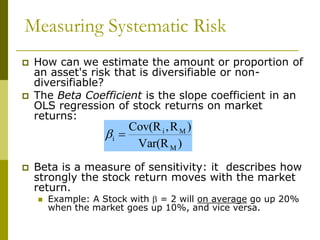

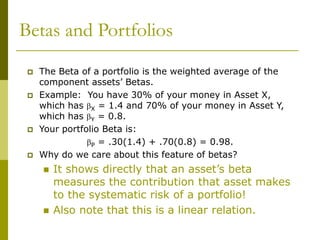

The Capital Asset Pricing Model (CAPM) formalizes the relationship between risk and expected return. It states that the expected return of an asset is determined by its sensitivity to non-diversifiable or systematic risk as measured by its beta. Beta measures how an asset's returns co-vary with the market portfolio. According to CAPM, an asset's expected return is equal to the risk-free rate plus its beta multiplied by the market risk premium. Diversification reduces risk by eliminating asset-specific or diversifiable risk, but not market risk.

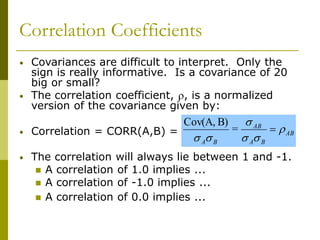

![Covariances and Correlations: The Keys to

Understanding Diversification

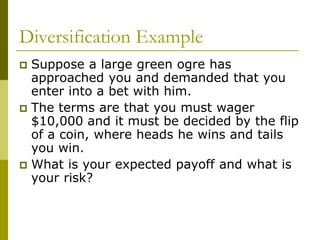

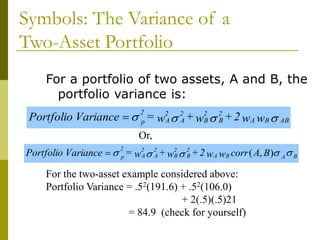

When thinking in terms of probability

distributions, the covariance between the returns

of two assets’ (A & B) equals Cov(A,B) = AB =

When estimating covariances from historical data,

the estimate is given by:

Note: An asset’s variance is its covariance with

itself.

p

])

E[R

-

R

])(

E[R

-

R

( s

B

B

A

A

S

1

=

s

s

s

)

R

-

R

)(

R

-

R

(

1

T

1

B

B

A

A

T

1

=

t

t

t

](https://image.slidesharecdn.com/capm-3-nt-221127124310-263195c8/85/CAPM-3-Nt-ppt-11-320.jpg)

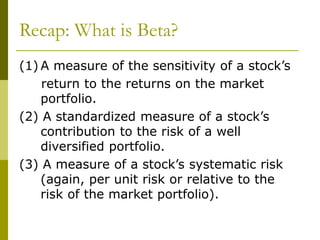

![For General Portfolios

• The expected return on a portfolio is the

weighted average of the expected returns

on each asset. If wi is the proportion of

the investment invested in asset i, then

N

i

i

i R

E

w

1

p ]

[

]

E[R

• Note that this is a ‘linear’ relationship.](https://image.slidesharecdn.com/capm-3-nt-221127124310-263195c8/85/CAPM-3-Nt-ppt-17-320.jpg)

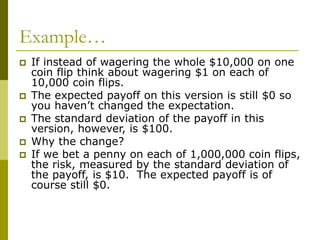

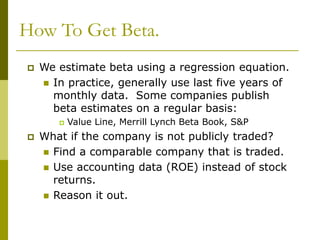

![CAPM Intuition: Recap

E[Ri] = RF (risk free rate) + Risk Premium

= Appropriate Discount Rate

Risk free assets earn the risk-free rate (think

of this as a rental rate on capital).

If the asset is risky, we need to add a risk

premium.

The size of the risk premium depends on the amount

of systematic risk for the asset (stock, bond, or

investment project) and the price per unit risk.

Could a risk premium ever be negative?](https://image.slidesharecdn.com/capm-3-nt-221127124310-263195c8/85/CAPM-3-Nt-ppt-34-320.jpg)

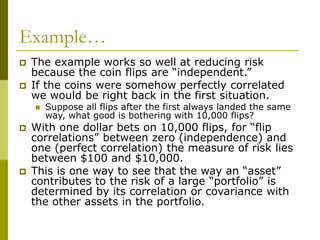

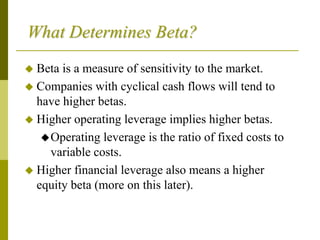

![The CAPM Intuition Formalized

]

R

]

[E[R

)

Var(R

)

R

,

Cov(R

R

]

E[R F

M

M

M

i

F

i

]

R

]

[E[R

R

]

E[R F

M

i

F

i

• The expression above is referred to as the “Security

Market Line” (SML).

Number of units of

systematic risk () Market Risk Premium

or the price per unit risk

or,](https://image.slidesharecdn.com/capm-3-nt-221127124310-263195c8/85/CAPM-3-Nt-ppt-35-320.jpg)

![The Market Risk Premium

The market is defined as a portfolio of all wealth including real

estate, human capital, etc.

In practice, a broad based stock index, such as the S&P 500 or

the portfolio of all NYSE stocks, is generally used.

]

R

]

[E[R F

M

The Market Risk Premium Is Defined As:

Historically, the market risk premium has been about 8.5% - 9%

above the return on treasury bills.

The market risk premium has been about 6.5% - 7% above the

return on treasury bonds.](https://image.slidesharecdn.com/capm-3-nt-221127124310-263195c8/85/CAPM-3-Nt-ppt-37-320.jpg)