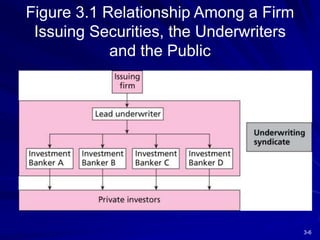

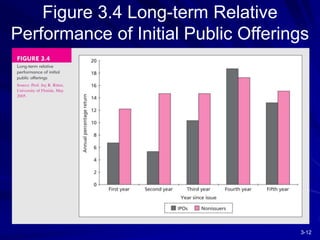

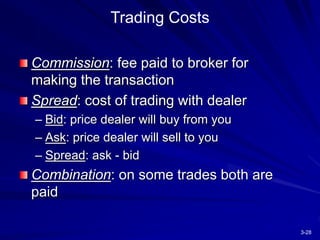

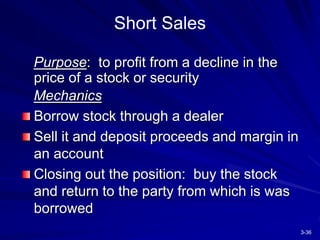

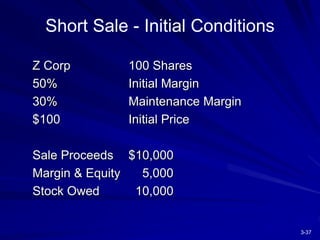

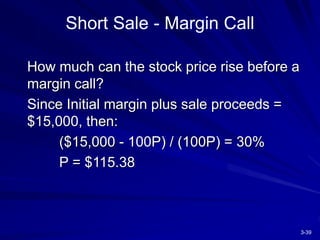

This document discusses how firms issue securities and how securities are traded in financial markets. It covers the primary and secondary markets, different methods of issuing securities like initial public offerings and private placements, and how securities are traded on exchanges and other trading systems. It also discusses regulations of securities markets like the Securities Acts of 1933 and 1934, and how trading is regulated through mechanisms like circuit breakers and restrictions on insider trading.