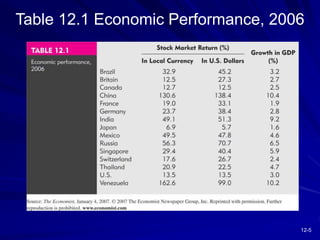

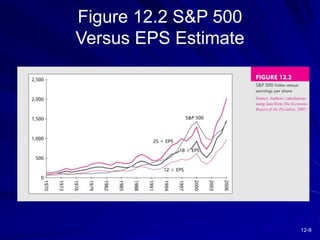

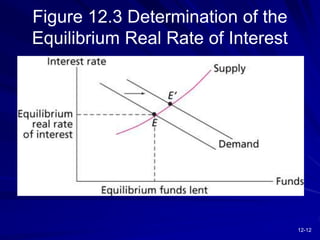

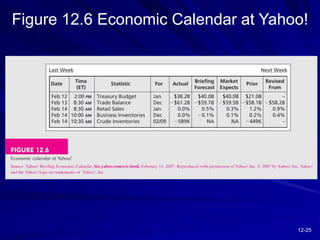

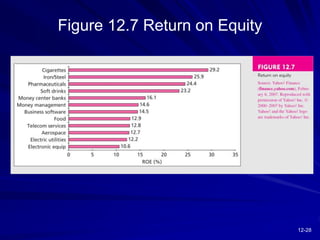

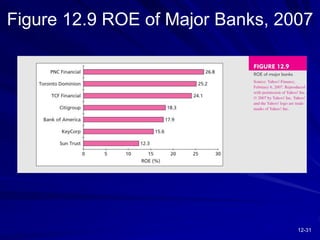

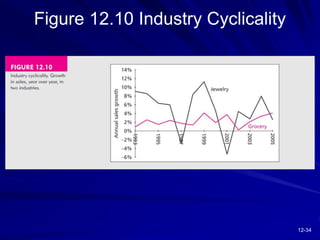

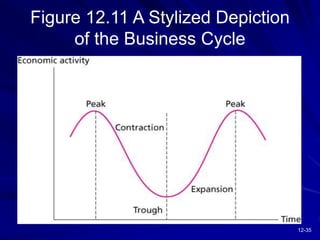

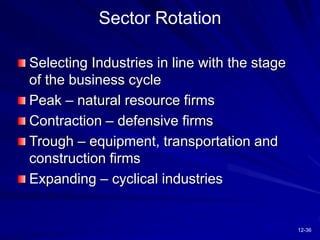

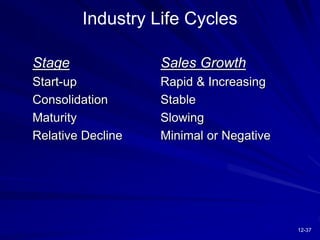

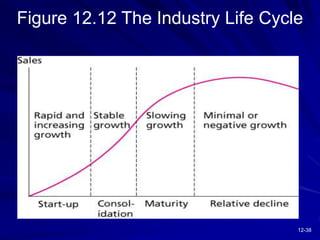

This document provides an overview of macroeconomic and industry analysis for fundamental analysis. It discusses analyzing the global economy, domestic macroeconomy, interest rates, demand and supply shocks, government policy, business cycles, and industry analysis. Key aspects covered include economic performance by country, key domestic economic variables, factors determining interest rates, types of demand and supply shocks, tools of monetary policy, leading/coincident/lagging economic indicators, defining and classifying industries, and how industry performance varies through the business cycle and industry life cycle.