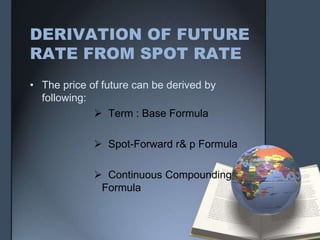

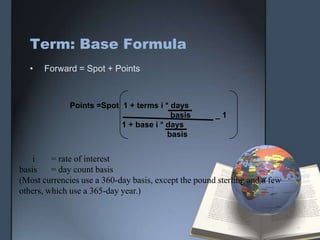

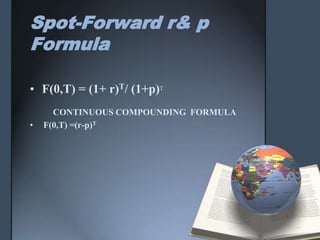

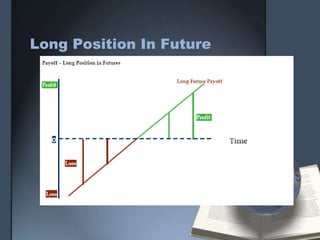

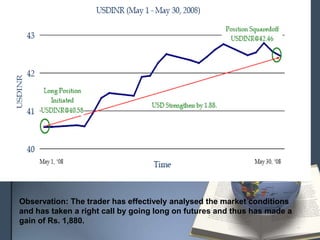

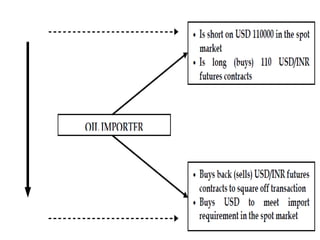

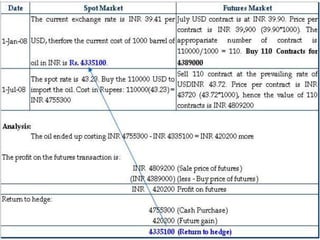

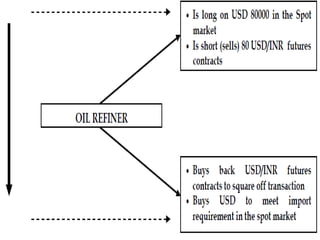

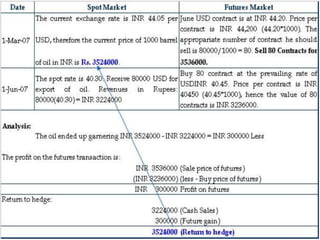

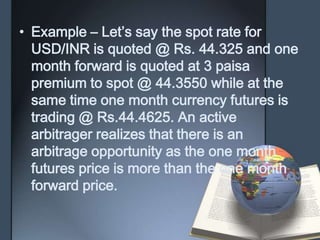

Currency derivatives allow investors to hedge risk and speculate on currency movements. Currency futures contracts are standardized contracts to buy or sell a currency at a specified date and price in the future. The price of a futures contract is derived using interest rate parity principles. Currency options provide the right but not the obligation to buy or sell a currency at a specified price. Over-the-counter currency options are tailored contracts for large institutions while exchange-traded currency options are standardized contracts traded on an exchange.