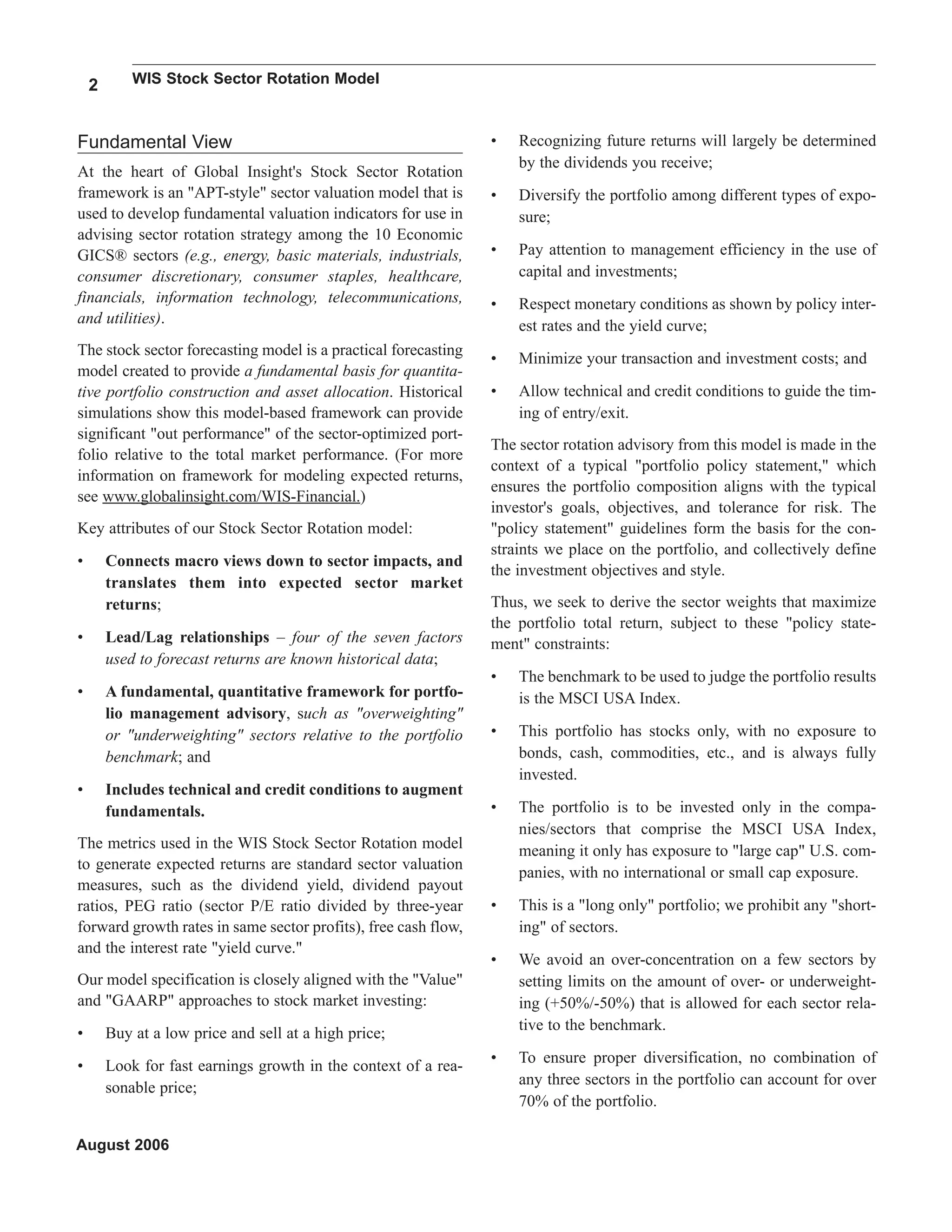

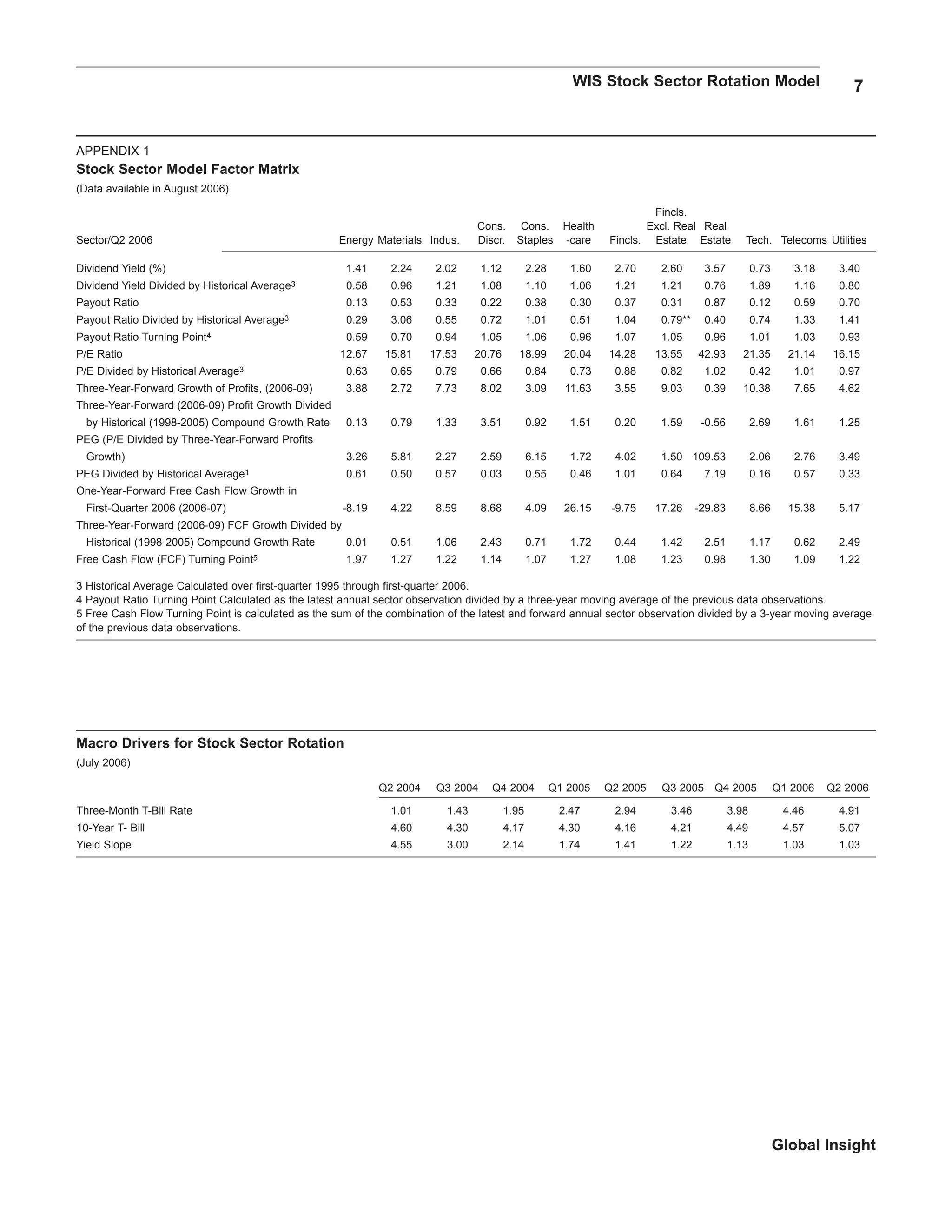

Global Insight's sector rotation model recommends overweight positions in consumer staples and healthcare over the next year based on fundamental, technical, and credit indicators. Consumer staples has compelling valuation, consistent profit growth, and improving credit quality. Healthcare also has attractive valuation and robust earnings growth prospects. In contrast, energy and consumer discretionary warrant underweight positions as their earnings growth outlook is weaker than other sectors. Technical indicators also point to negative momentum for consumer discretionary.