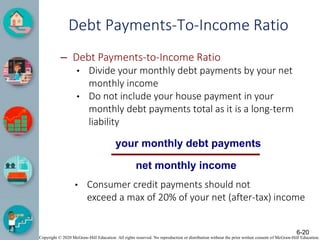

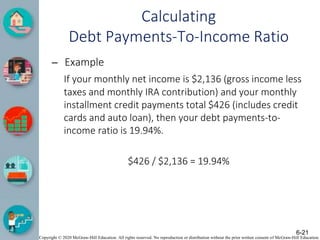

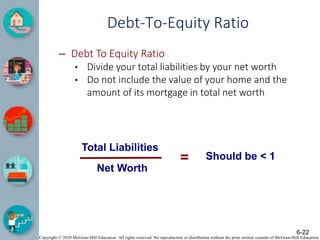

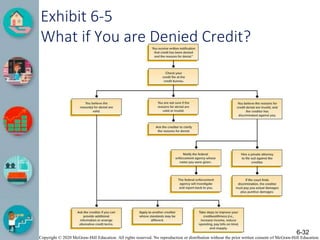

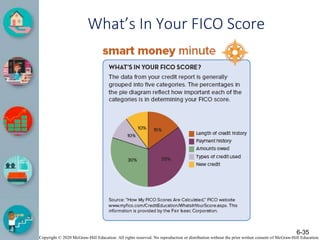

This document contains a chapter from a textbook on consumer credit. It discusses various topics related to consumer credit, including defining consumer credit, analyzing advantages and disadvantages of consumer credit, different types of credit (closed-end, open-end, credit cards, debit cards), measuring credit capacity, and protecting against credit and debit card fraud. The chapter contains learning objectives and covers topics like assessing if a loan is affordable, debt-to-income ratios, and factors creditors consider in credit applications.