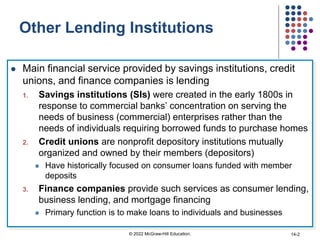

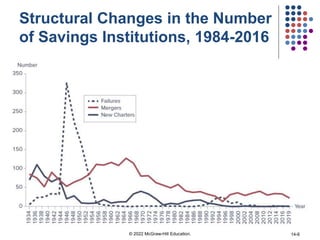

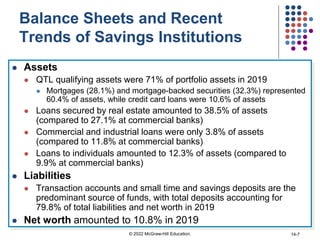

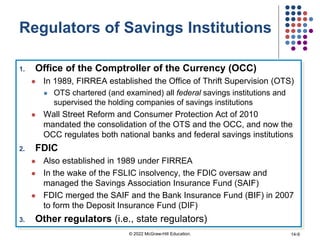

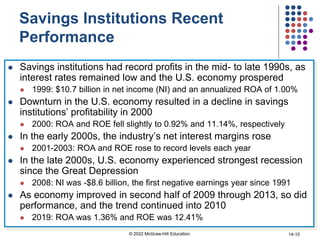

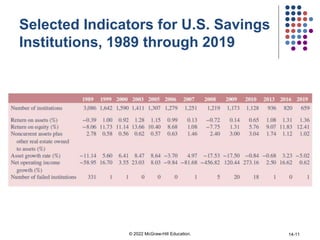

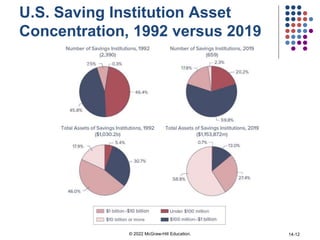

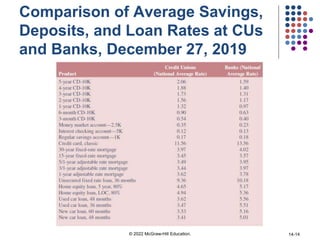

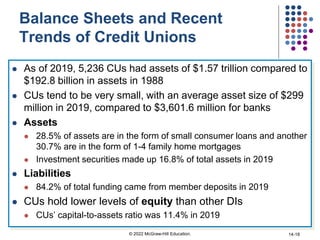

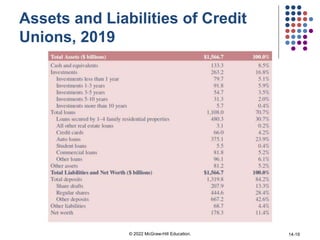

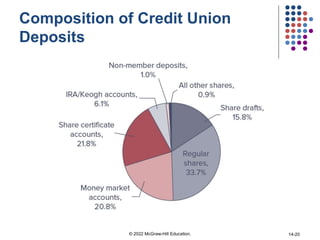

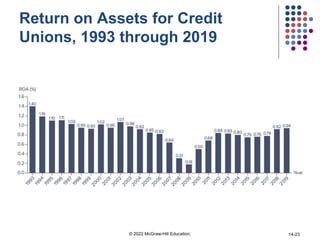

This document provides an overview of other lending institutions besides commercial banks, including savings institutions, credit unions, and finance companies. It discusses the historical origins and roles of each type of institution, compares their balance sheets and regulatory frameworks, and analyzes trends in their performance and consolidation over time. Key topics covered include the savings and loan crisis of the 1980s-90s, differences between savings banks and credit unions, types of finance companies, and how each sector has adapted to increasing competition.