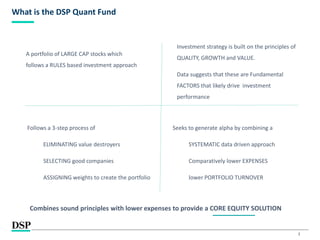

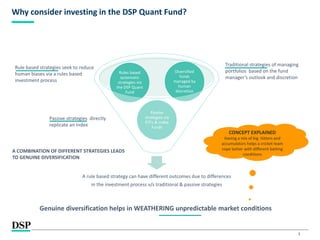

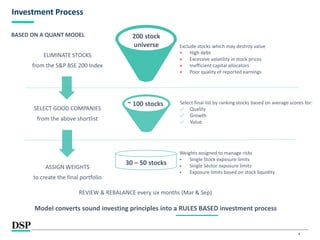

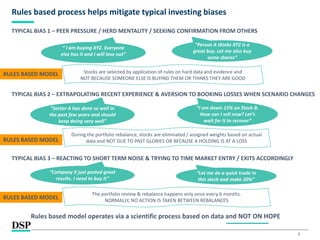

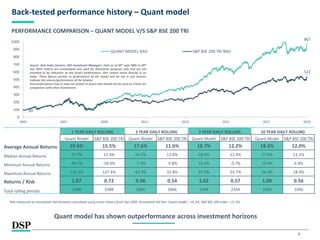

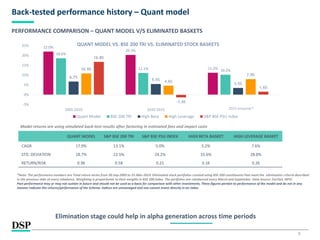

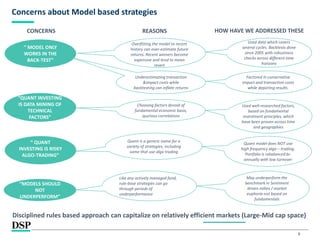

The document provides an introduction to the DSP Quant Fund, a rules-based equity fund that follows a quantitative investment strategy. It describes the fund's process of eliminating value-destroying stocks, selecting good companies based on quality, growth, and value factors, and assigning weights to create the portfolio. The strategy seeks to generate alpha through a systematic, data-driven approach with lower expenses and portfolio turnover compared to other funds. Back-tested performance data from 2005 to 2019 shows the quant model outperformed the benchmark index across various periods on a risk-adjusted basis. The document addresses some potential concerns around model-based strategies and quant investing. It also introduces the quantitative research team that developed the fund's investment model.

![[Title to come]

[Sub-Title to come]

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

November 2019

| People | Processes | Performance |

DSP Quant Fund

Introduction](https://image.slidesharecdn.com/dspquantfund-introduction-191111115315/85/DSP-Quant-Fund-Introduction-1-320.jpg)