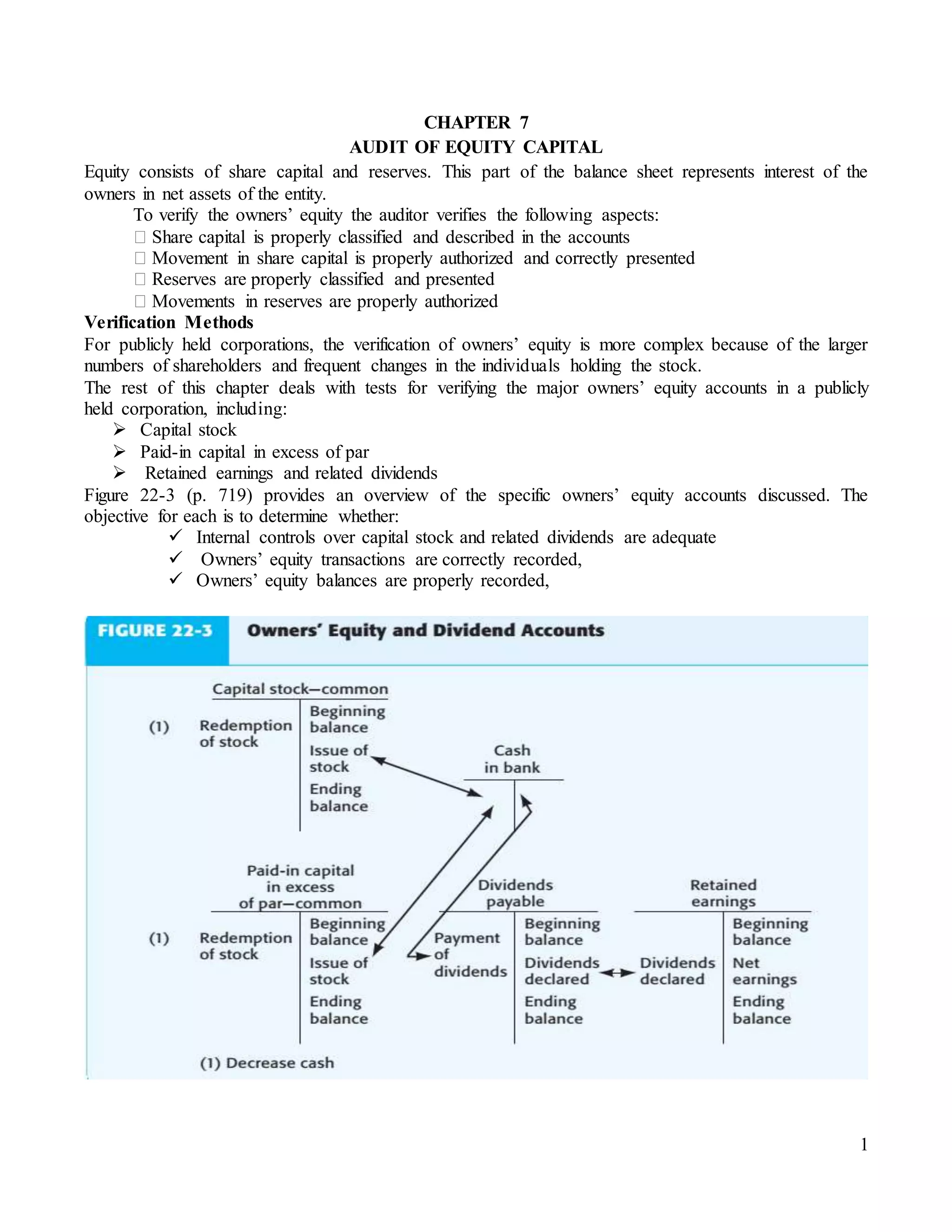

1. The document discusses auditing procedures for owners' equity accounts, including capital stock, paid-in capital, retained earnings, and dividends.

2. The auditor verifies that owners' equity transactions are properly authorized and accurately recorded in the accounts. For capital stock, this includes confirming share amounts with transfer agents and examining board meeting minutes.

3. The auditor also confirms that retained earnings are properly adjusted for net income/loss and dividends declared, and that presentation and disclosure requirements are met.