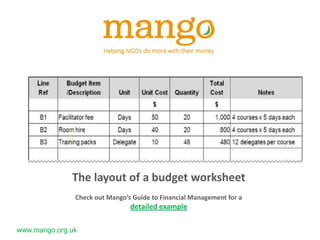

The document outlines the essential components of financial management for NGOs, emphasizing the importance of financial planning to achieve organizational objectives. Key elements include operational budgets, fundraising plans, and financing strategies, all of which require monitoring and adjustments throughout implementation. The text also provides tips for creating effective budgets, highlighting the need for clarity, accuracy, and collaboration in the budgeting process.