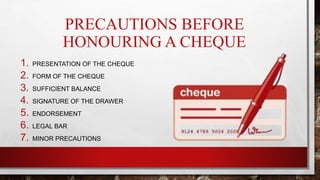

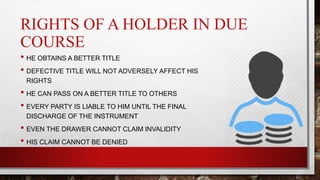

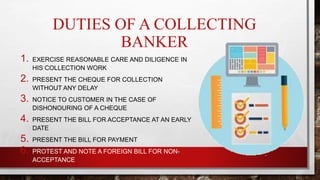

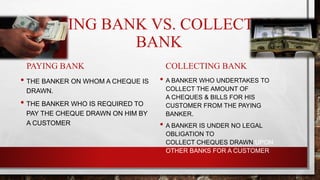

The document discusses key concepts related to cheque processing and payment between banks. It defines a paying banker as the bank upon which a cheque or bill is drawn and pays it. A collecting banker collects the proceeds of a cheque on behalf of a customer from the paying banker. The document outlines precautions a paying banker takes before honoring a cheque, reasons for dishonoring a cheque, statutory protections, and duties of a collecting banker. It distinguishes a paying banker, who is required to pay cheques drawn on it, from a collecting banker, who collects cheque amounts from paying bankers on behalf of customers.