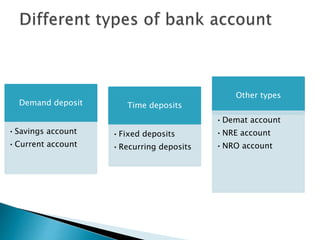

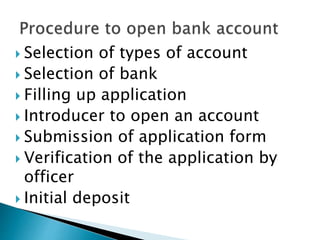

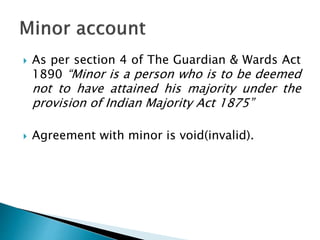

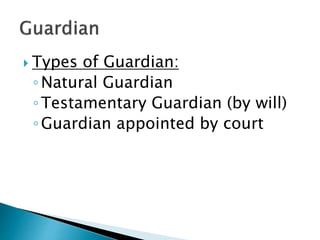

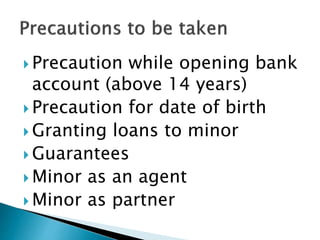

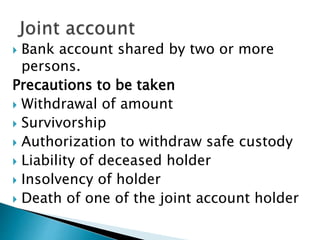

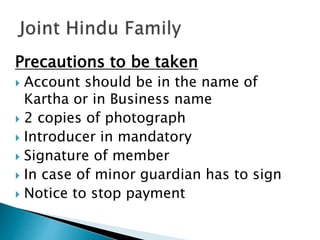

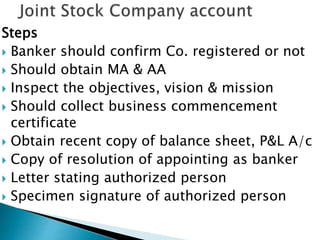

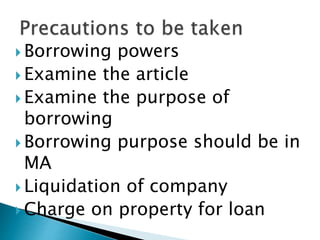

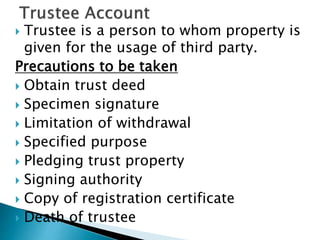

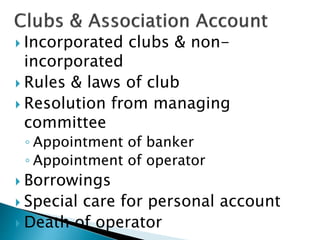

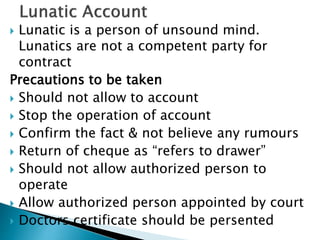

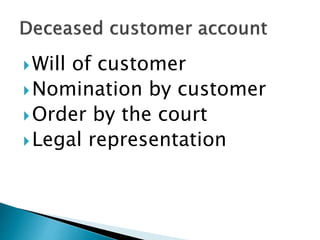

The document outlines various types of bank accounts and procedures for opening and managing them, including demand deposits, savings accounts, and accounts for minors or partnerships. It emphasizes the legal considerations and responsibilities tied to different account holders, guardianship, and precautions necessary for account operations. Additionally, it covers the requirements for opening accounts for clubs, trusts, and companies, addressing issues like authority, borrowing, and documentation needed.