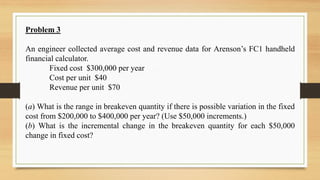

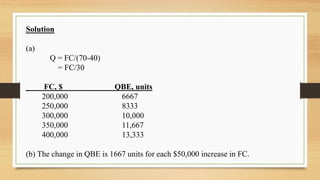

1. Sensitivity analysis determines how changes in input parameters impact the output measures of an economic analysis. Parameters like costs, salvage values, and lives can impact measures like net present worth.

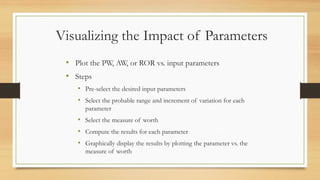

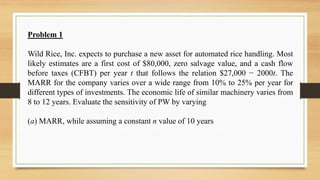

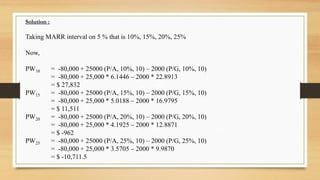

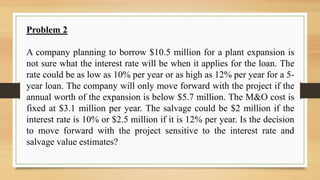

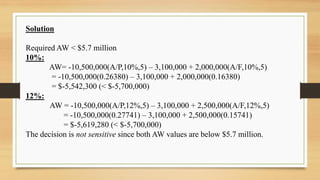

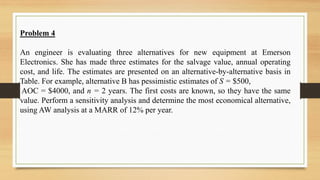

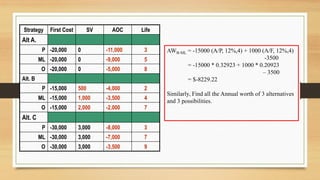

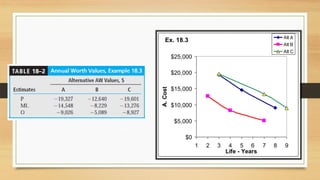

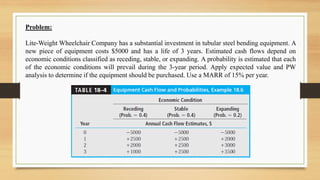

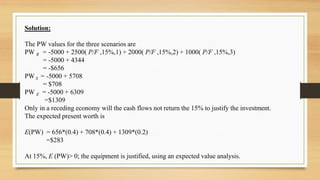

2. Three common methods for analyzing sensitivity are: plotting parameter values against output measures, using a pessimistic, most likely, and optimistic estimate for each parameter, and determining the expected value when probabilities of different outcomes are known.

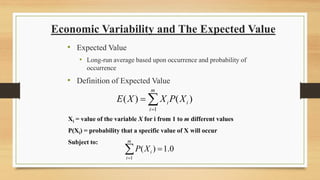

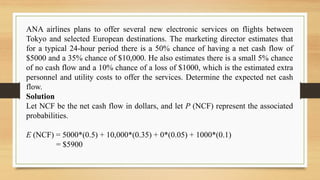

3. The expected value approach sums the product of each possible outcome and its probability to determine the long-run average outcome when variability exists. This allows decisions to account for economic uncertainty.