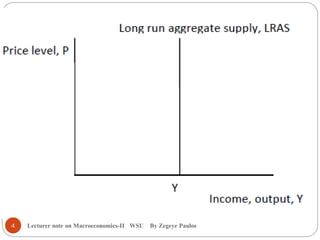

1) The document discusses four models of short-run aggregate supply: the sticky-price model, imperfect information model, and sticky-wage model.

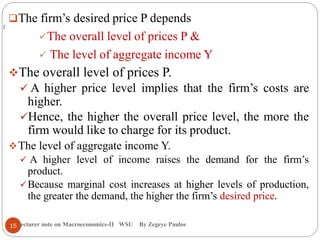

2) In the sticky-price model, some prices are fixed in the short-run due to contracts or costs of changing prices. This can cause output to deviate from natural levels when demand changes.

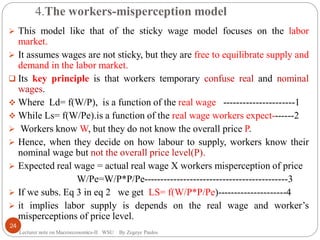

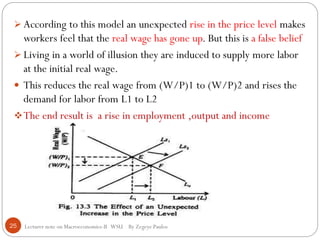

3) The imperfect information model assumes suppliers don't know the overall price level when making decisions. Output will rise if actual prices are above expected prices.

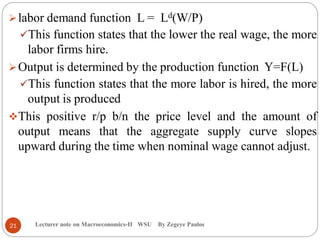

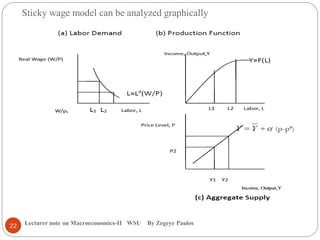

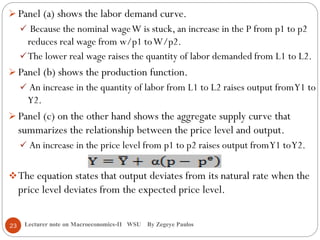

4) In the sticky-wage model, nominal wages are fixed by contracts in the short-run. A price rise will lower real wages and induce firms to hire more workers and produce more output

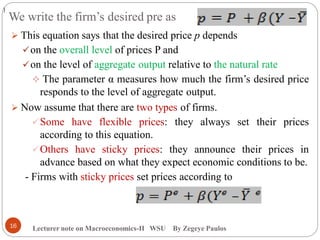

![Then the overall price level is

Lecturer note on Macroeconomics-II WSU By Zegeye Paulos

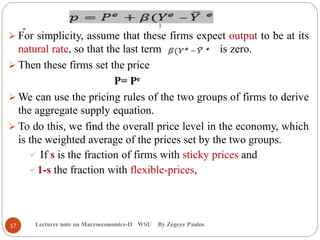

Now subtract (1-s)p from both sides of this equation to obtain

Divide both sides by s to solve for the overall price level:

Hence, the overall all price level depends on the expected price

level and on the level of output.

where α = s/[1-s) β]. We have

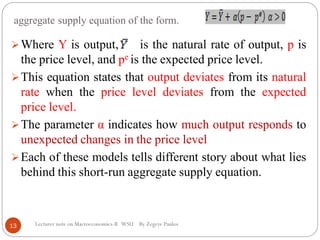

The deviation of output from the natural rate is positively

associated with the deviation of the price level from the

expected price level.

18](https://image.slidesharecdn.com/macch-2-180515064540/85/Macro-Economics-II-Chapter-Two-AGGREGATE-SUPPLY-18-320.jpg)