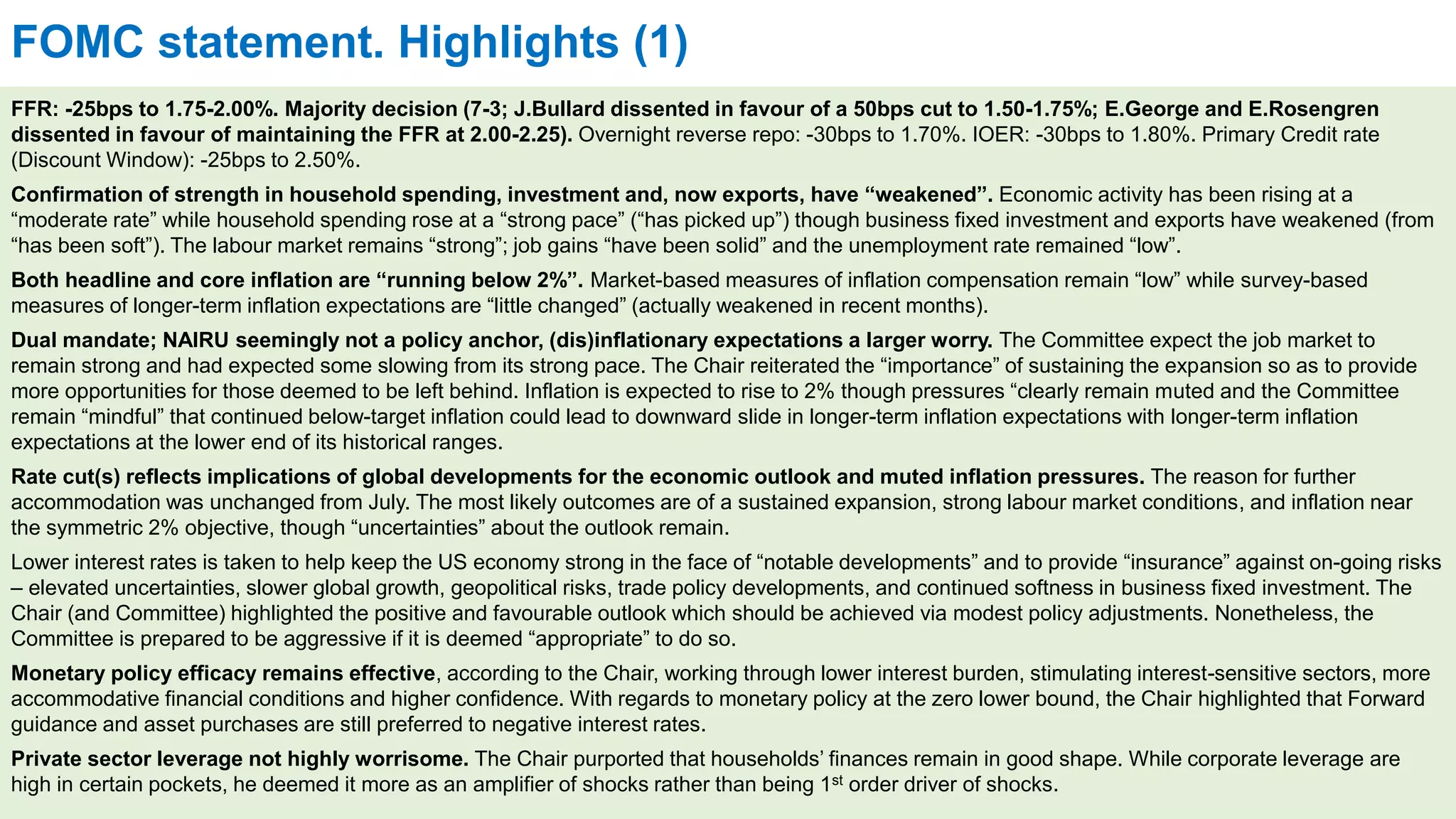

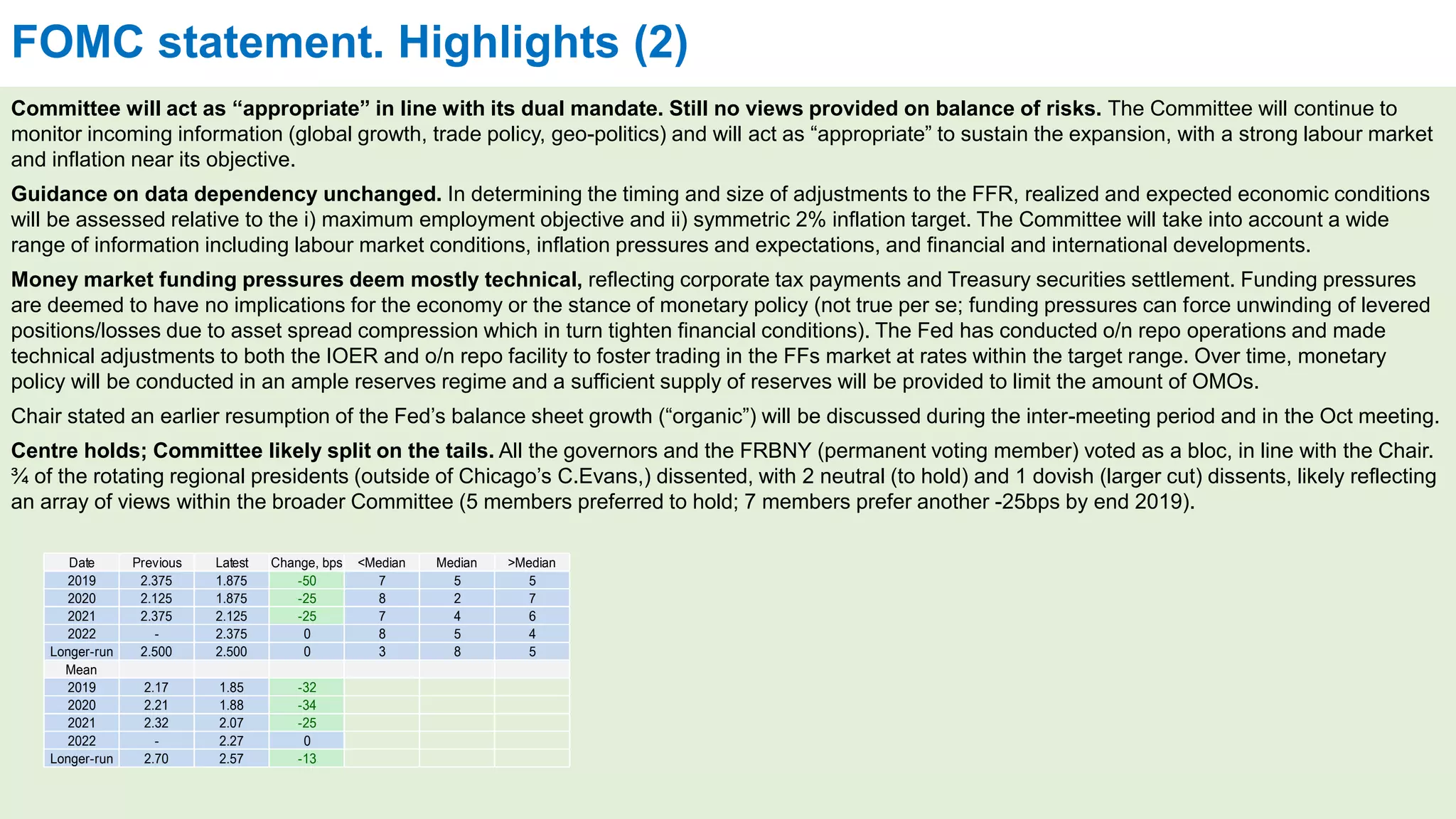

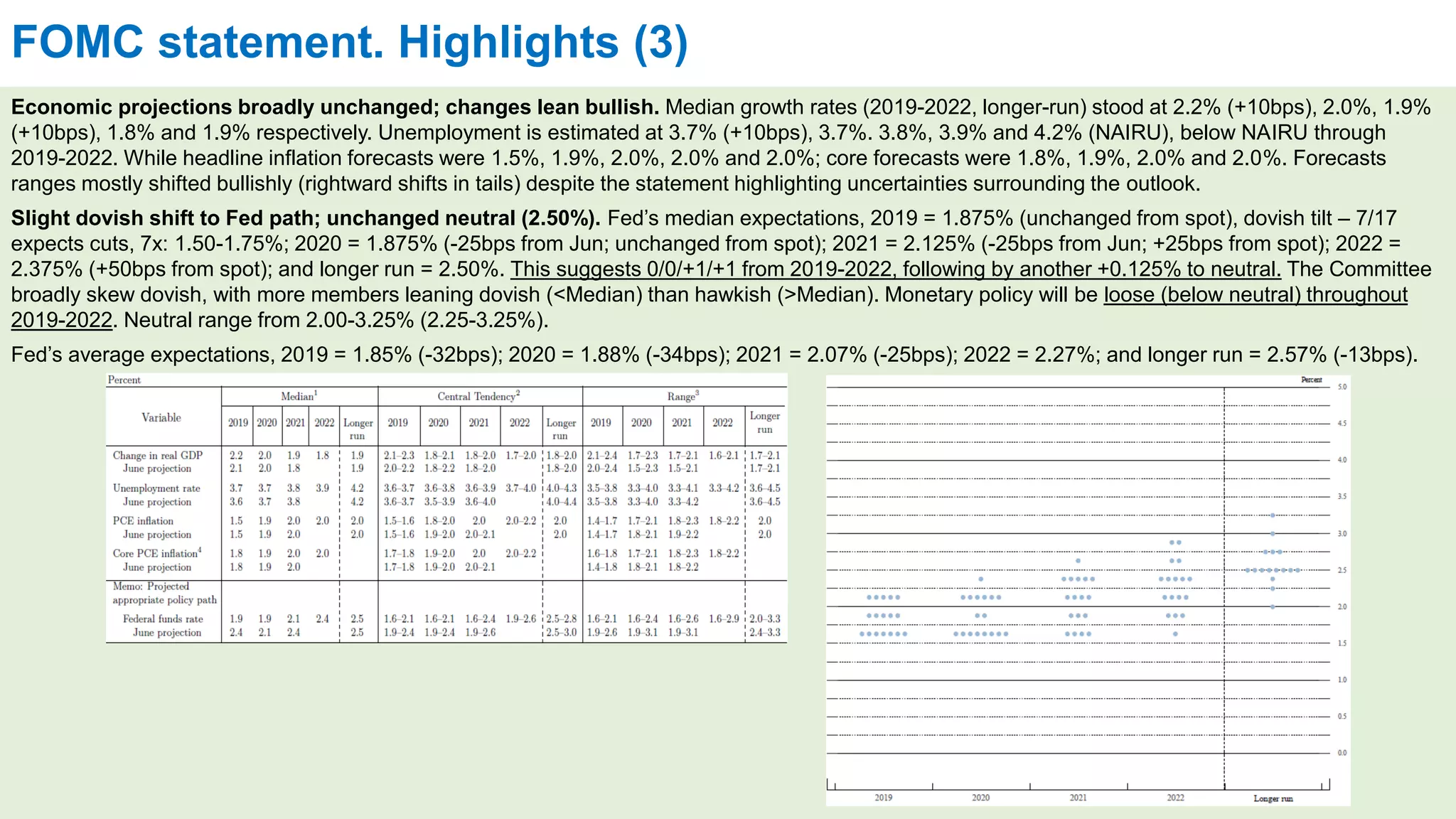

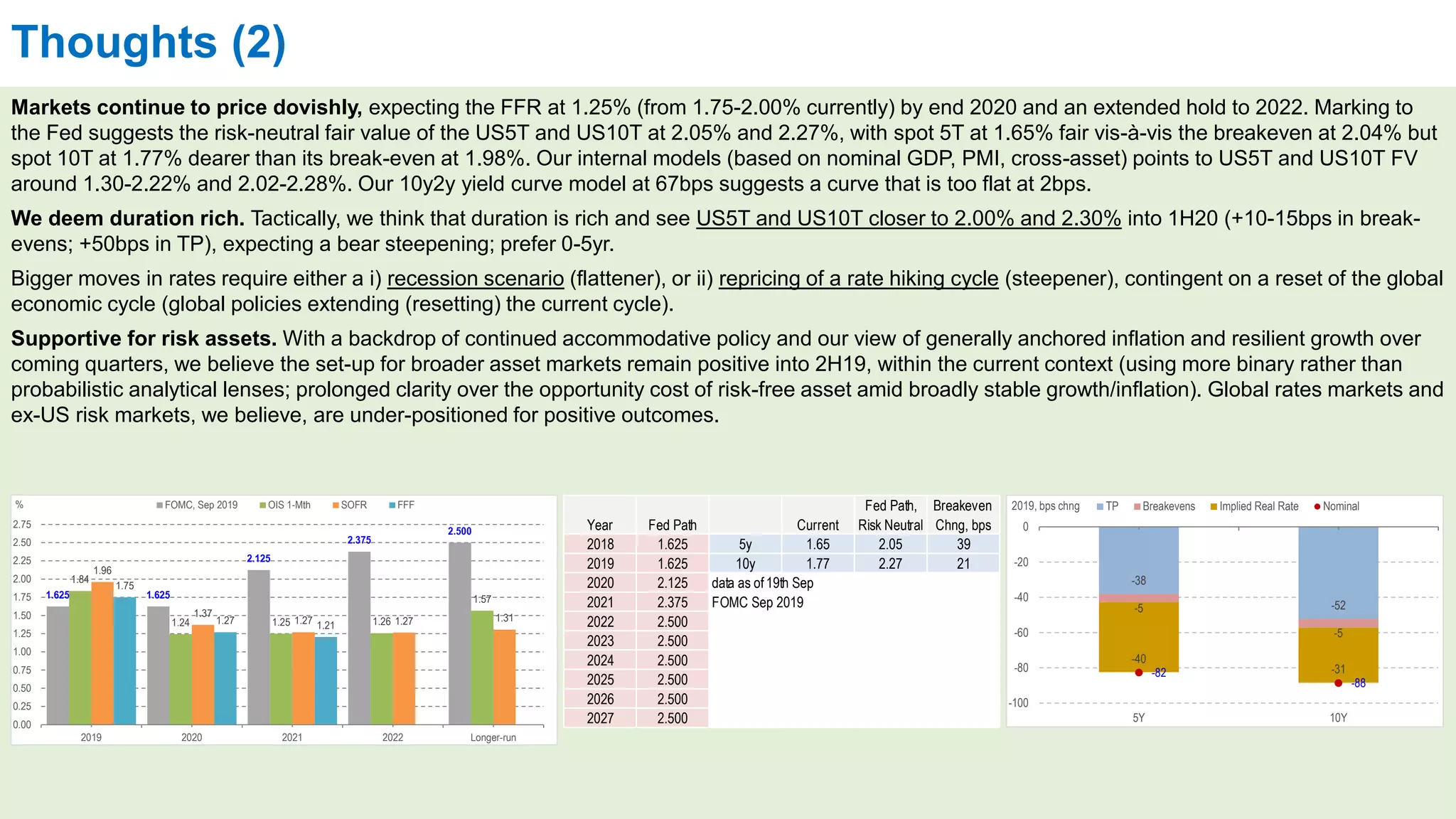

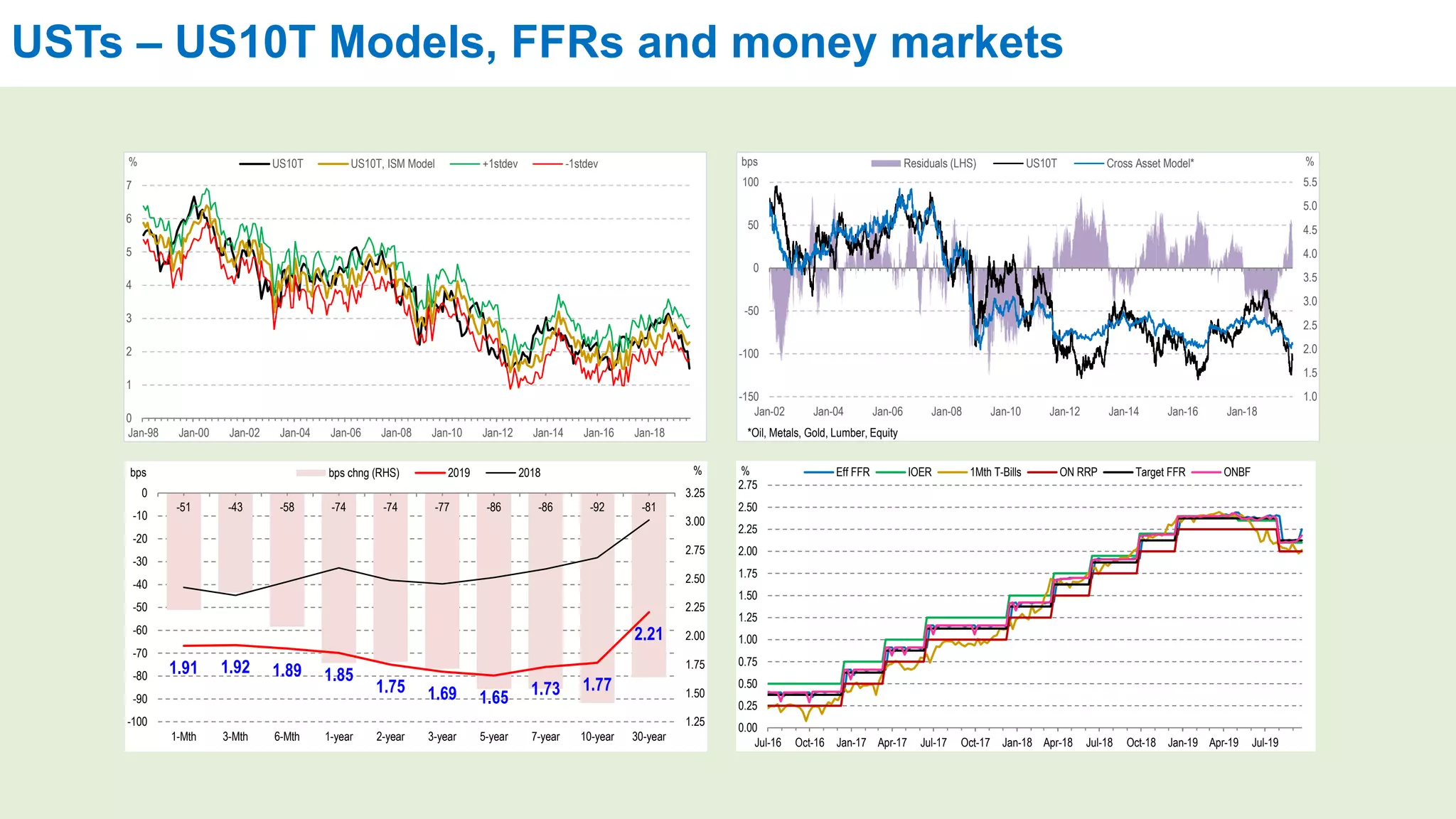

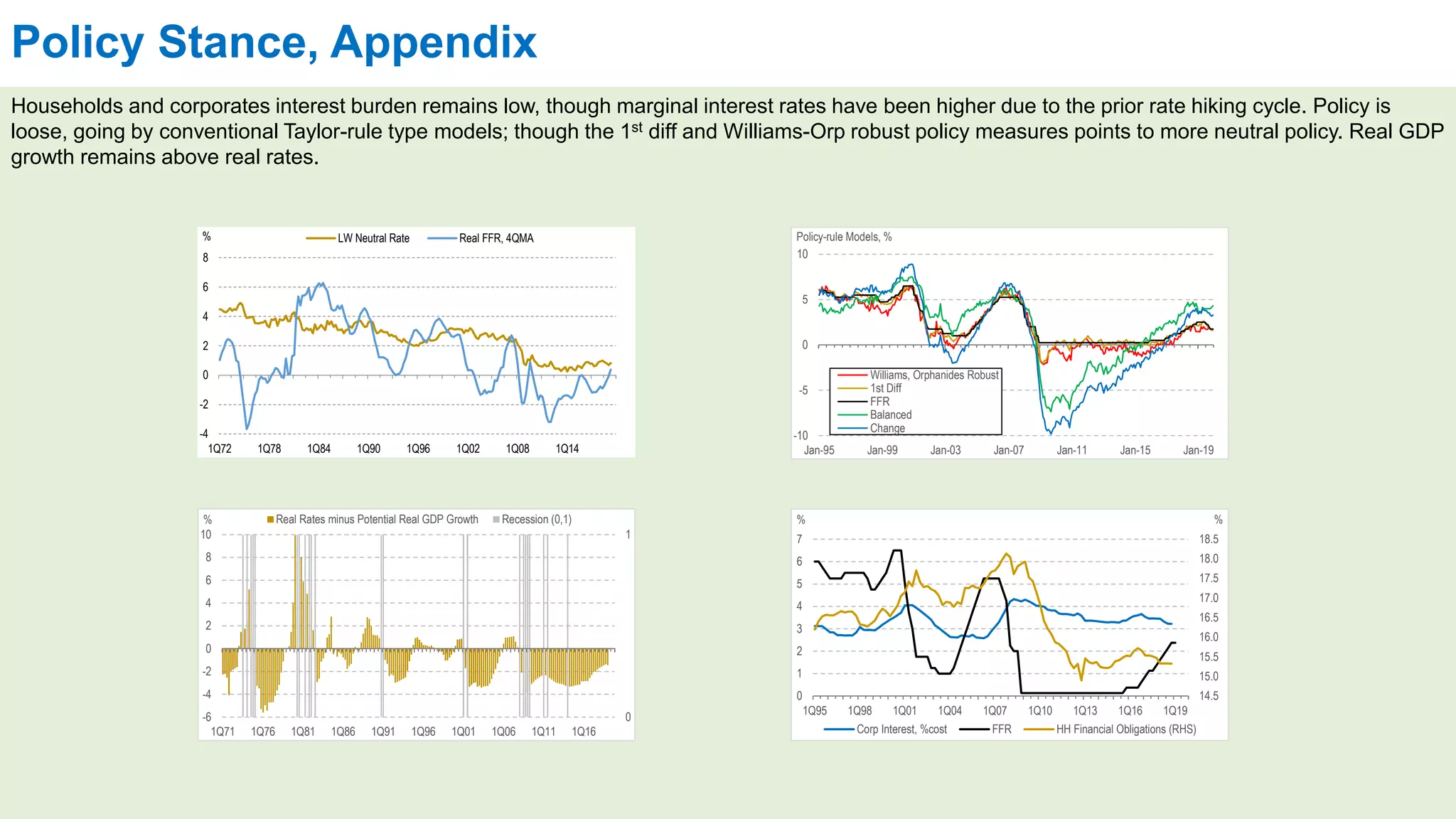

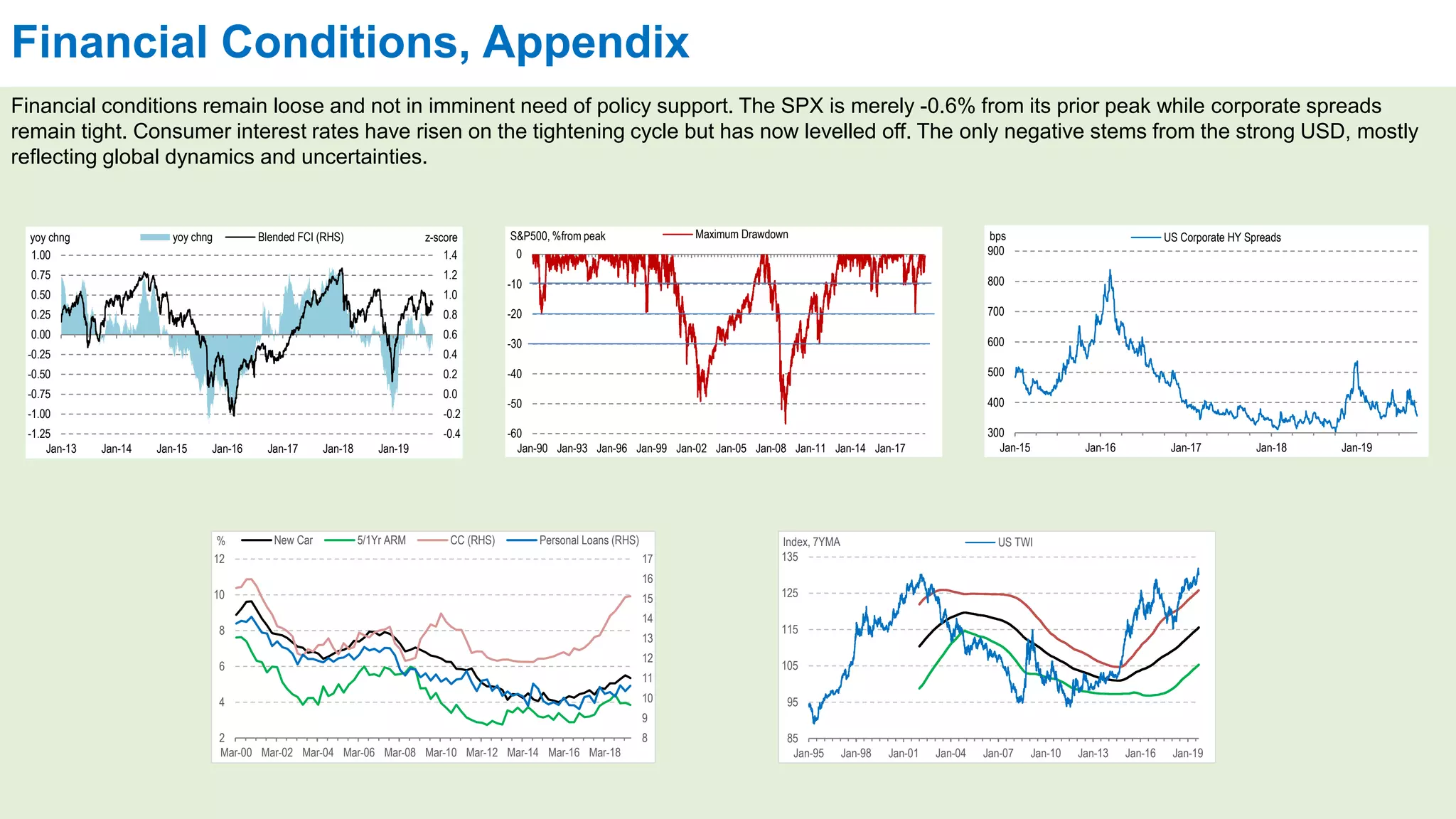

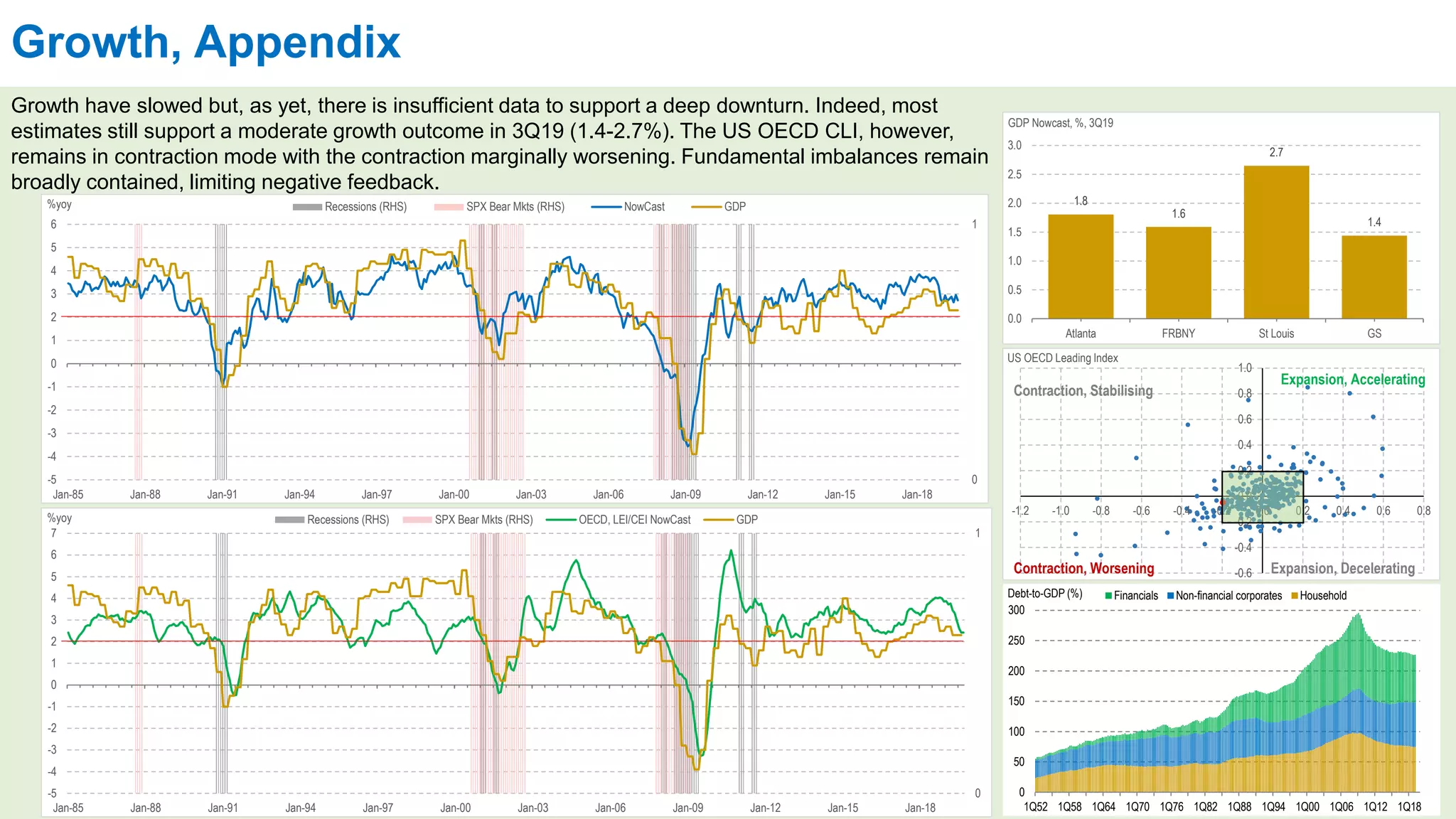

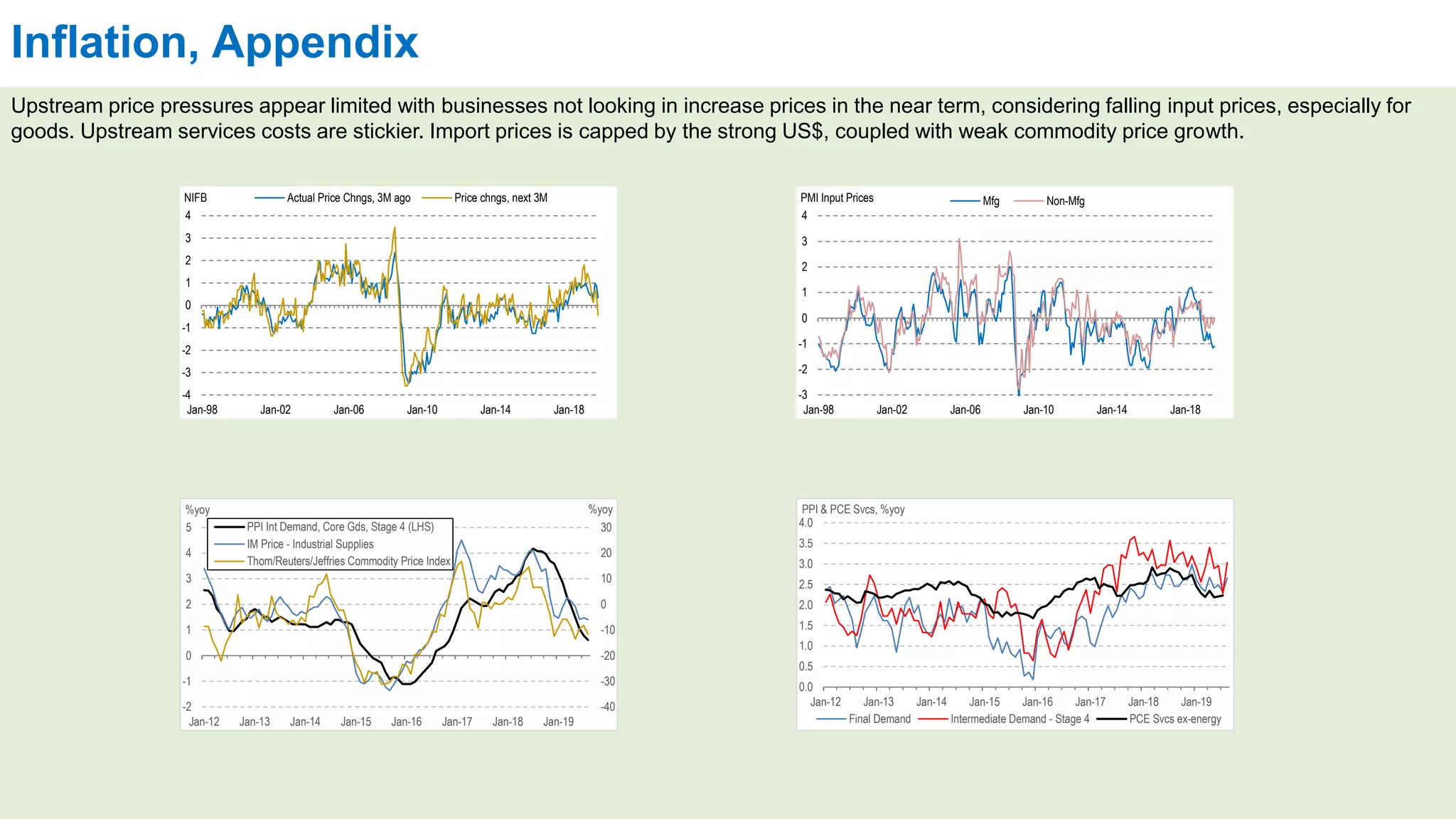

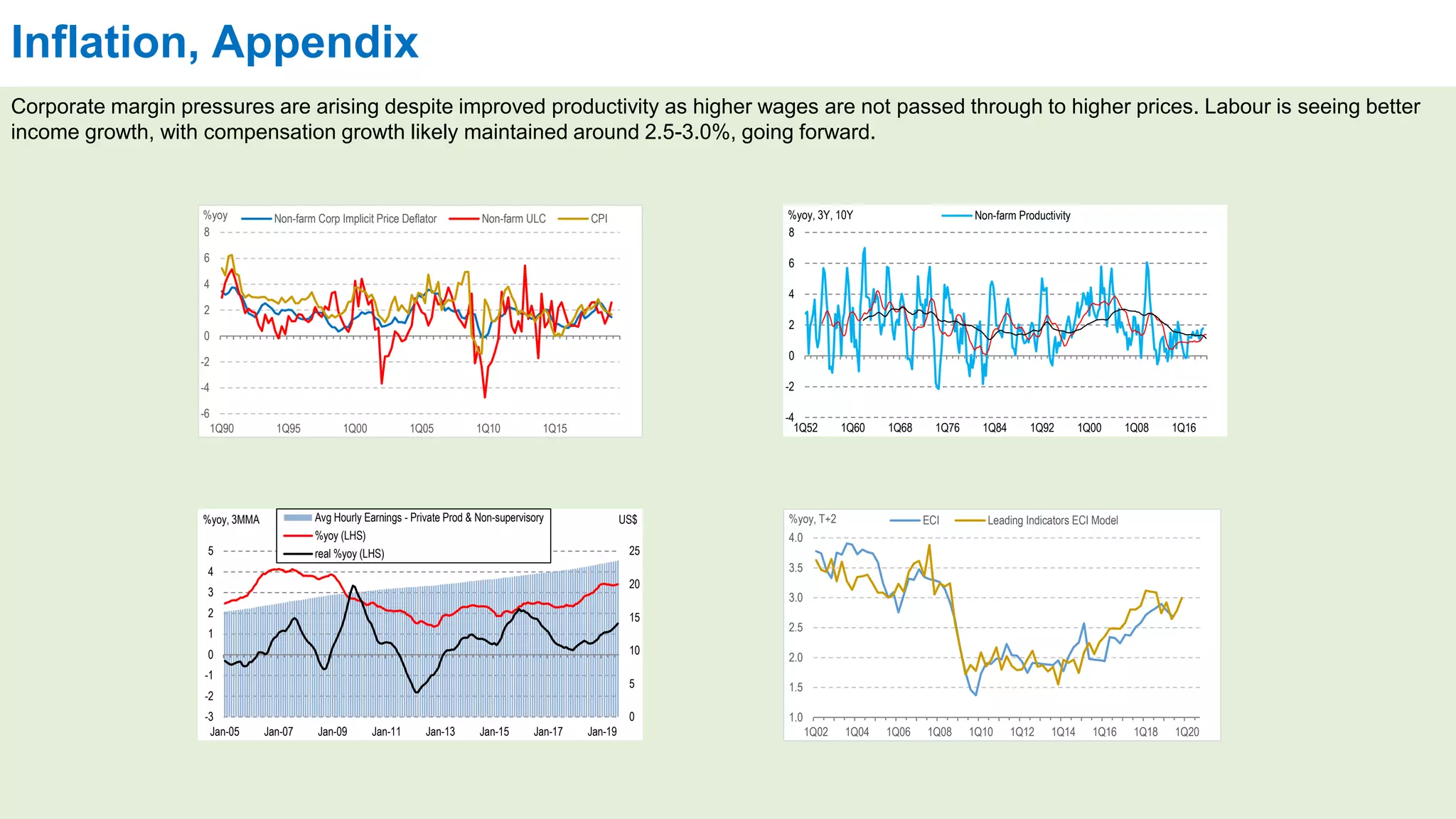

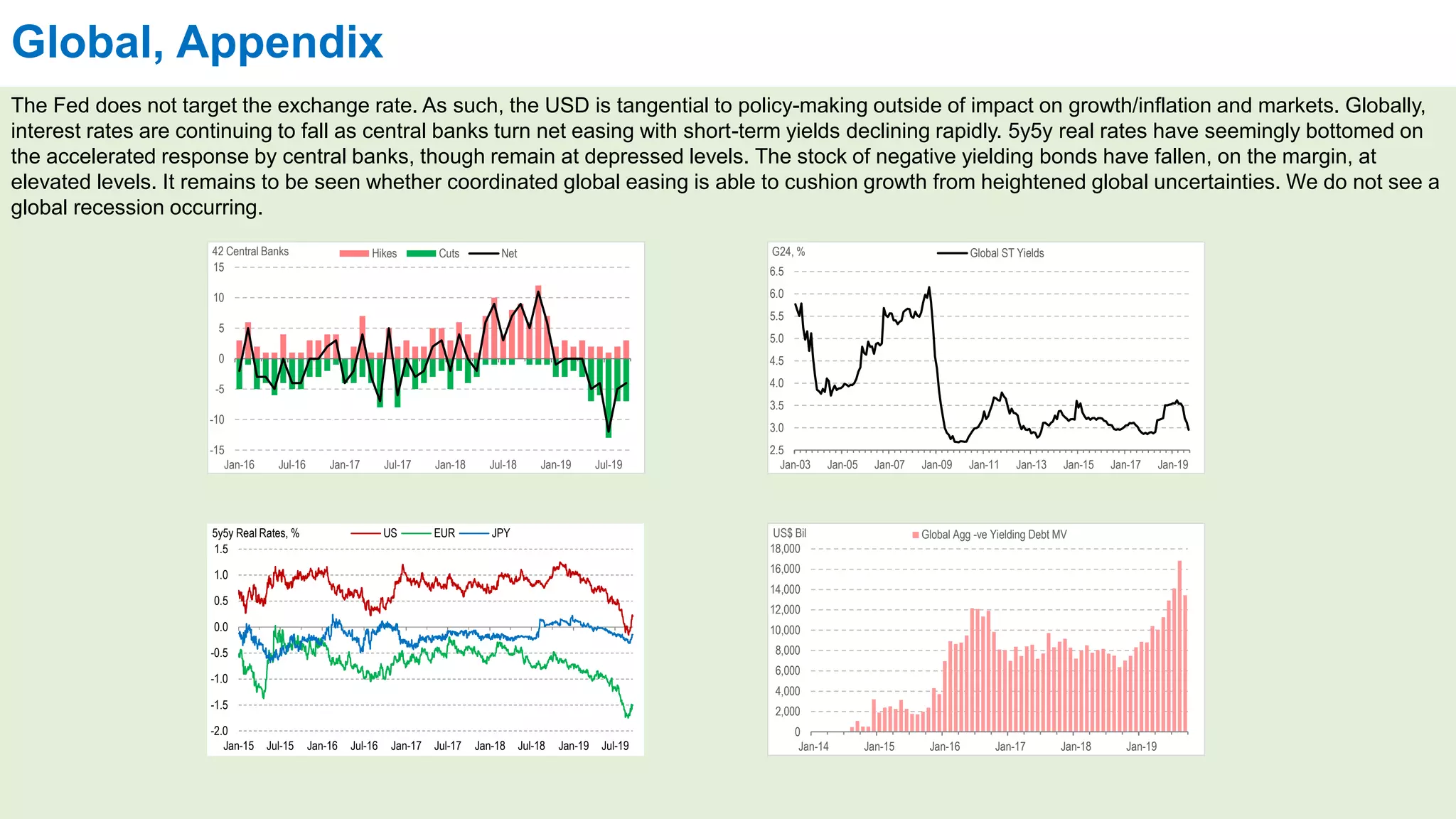

The FOMC statement released highlights a reduction in the federal funds rate by 25 basis points to the range of 1.75-2.00%. The committee acknowledges moderate economic growth with strong household spending but weakened business investment and exports, while inflation rates remain below the 2% target. The Fed signals a willingness to implement further cuts if necessary, citing global economic developments and subdued inflation pressures as key factors for continued monetary accommodation.