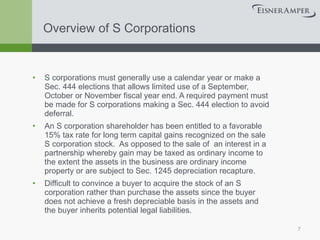

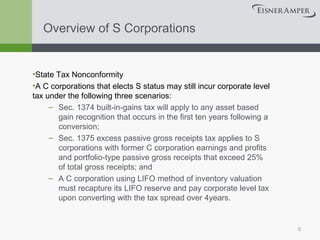

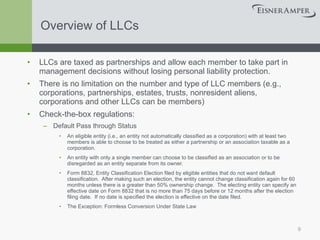

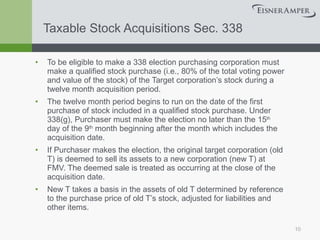

This document discusses different entity structures for operating a business including C corporations, S corporations, and LLCs. C corporations are subject to double taxation while S corporations allow profits and losses to pass through to shareholders. S corporations have advantages over partnerships for highly profitable businesses since income is not subject to self-employment tax. LLCs are taxed as partnerships, allow flexible membership, and provide liability protection. The document also summarizes tax considerations for stock acquisitions under Sections 338 and 338(h)(10).

![With You Today Jon Zefi LL.M., J.D., M.B.A. Tax Partner EisnerAmper LLP 750 Third Avenue New York, New York 10017 (212) 891-4064 [email_address]](https://image.slidesharecdn.com/sept12011-13153195802957-phpapp02-110906093416-phpapp02/85/Sept-1-2011-2-320.jpg)