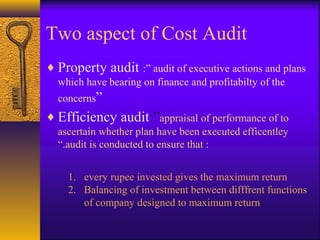

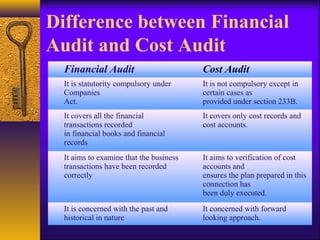

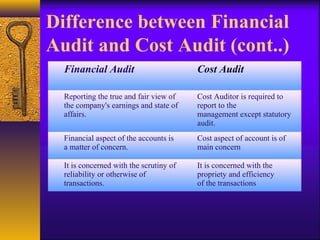

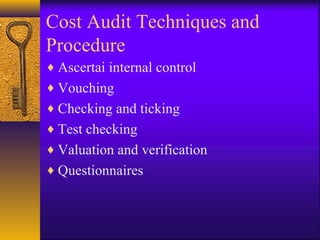

This document provides an overview of cost auditing. It defines cost auditing as checking costing systems and accounts to verify correctness and ensure adherence to cost accounting objectives. The objectives of cost auditing include determining and controlling costs to provide data for operational efficiency judgments. Cost auditing was first made mandatory in India and aims to curb profiteering and help pricing decisions. Key aspects reviewed in a cost audit are property/investment and efficiency. The cost auditor examines materials, labor, overhead records and more to assess performance and maximize returns.