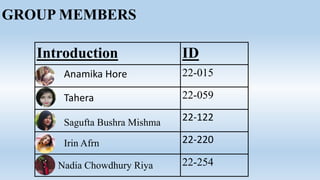

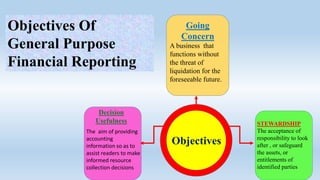

This document discusses the conceptual framework for financial reporting. It provides an introduction to the group members and then discusses key aspects of the conceptual framework including:

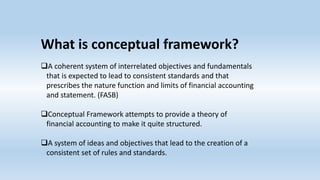

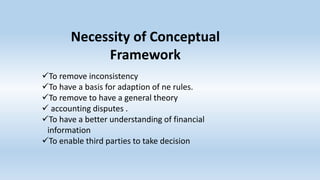

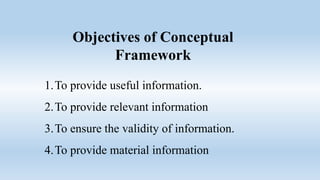

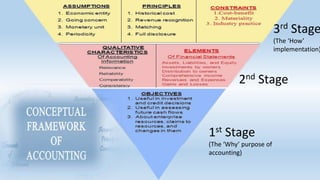

1. The definition, necessity, and objectives of a conceptual framework

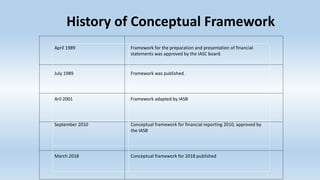

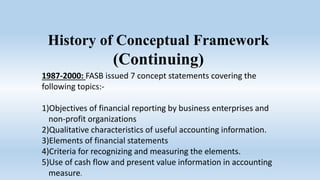

2. The history of developing conceptual frameworks including key documents from FASB and IASB

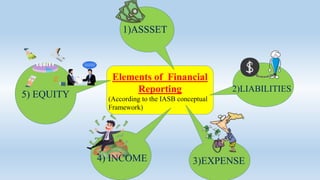

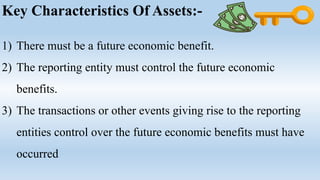

3. Key elements of financial reporting like assets, liabilities, income, and equity

4. Qualitative characteristics that enhance financial reporting such as comparability, verifiability, timeliness, and understandability.