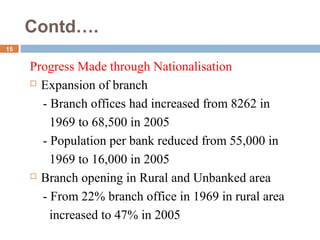

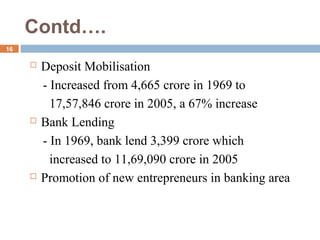

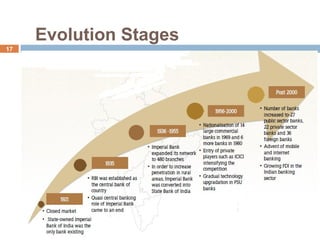

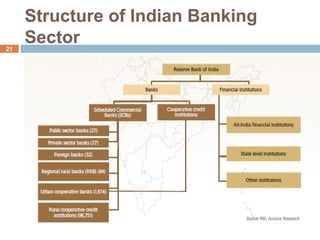

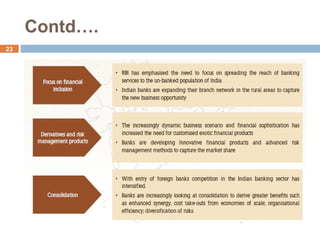

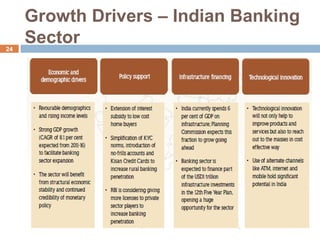

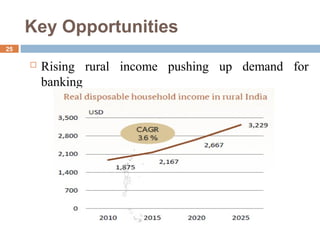

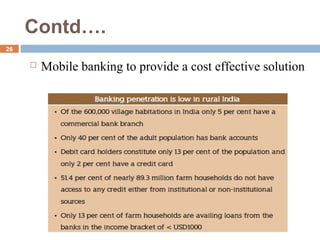

This document provides an overview of commercial banking in India. It defines what a commercial bank is, traces the history of banking in India from the 18th century to present day, and outlines the key stages of evolution and reforms in the Indian banking sector. It discusses the objectives and impacts of nationalizing banks in 1969 and 1980. The document also describes the current structure of the Indian banking sector and identifies some major trends, growth drivers, and opportunities in commercial banking going forward, such as rising rural incomes and the potential for mobile banking.