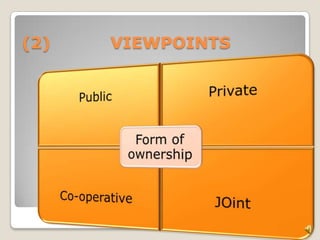

The document discusses various types and functions of banks. It describes the different types of banks based on ownership (public sector, private sector, cooperative), organizational structure (scheduled, non-scheduled), field of work (commercial, agricultural, industrial), registration (scheduled, non-scheduled), area (local, national, global), location (urban, rural), and branches (unit banks, banks with branches). It also outlines key functions of commercial banks such as accepting deposits, lending money, making investments, and facilitating inter-bank transactions.