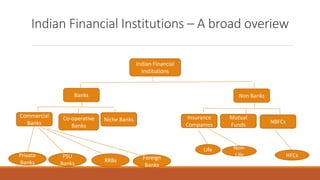

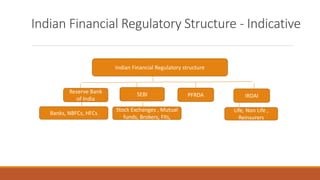

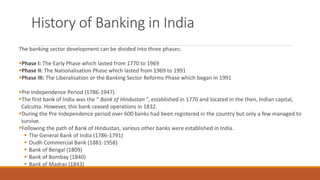

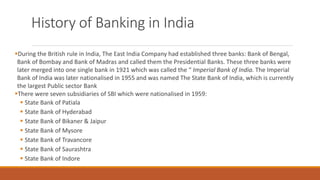

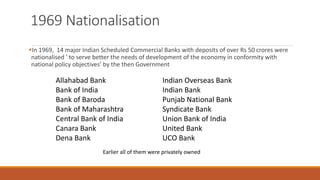

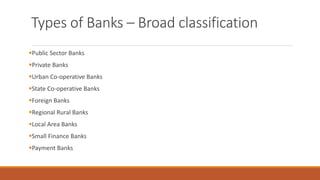

This document provides notes from a class on bank management. It begins with a disclaimer stating that the notes are intended for educational purposes only. It then outlines the course learning outcomes, course structure including assessments, and support needed from students. The rest of the document provides an overview of the history and evolution of banking in India, including the nationalization of banks in 1969 and 1980, as well as a broad overview of the various types of banks and financial institutions in India today. It also discusses the role and functions of the Reserve Bank of India as the central bank of the country.

![Licensing

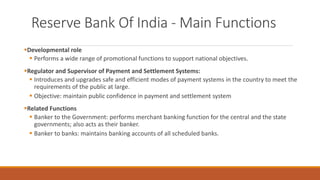

Licensing of banking companies

▪No company shall carry on banking business in India unless it holds a license issued in that behalf by the Reserve

Bank and any such license may be issued subject of such conditions as the Reserve Bank may think fit to impose

▪Guidelines for ‘on tap’ Licensing of Universal Banks in the Private Sector

▪Eligible Promoters

(i) Individuals/professionals who are ‘residents’ and have 10 years of experience in banking and finance at a

senior level.

(ii) Entities/groups in the private sector that are ‘owned and controlled by residents’ [as defined in FEMA

Regulations, as amended from time to time] and have a successful track record for at least 10 years, provided

that if such entity/group has total assets of ₹ 50 billion or more, the non-financial business of the group does not

account for 40 per cent or more in terms of total assets/in terms of gross income.

(iii) Existing non-banking financial companies (NBFCs) that are ‘controlled by residents’ and have a successful

track record for at least 10 years. For the sake of clarity, it is added here that any NBFC, which is a part of the

group that has total assets of ₹ 50 billion or more and that the non-financial business of the group accounts for

40 per cent or more in terms of total assets/in terms of gross income, is not eligible.](https://image.slidesharecdn.com/bankmanagement-classdiscussions1-240204134714-4101a677/85/Bank-Management-Class-discussions-1-pdf-23-320.jpg)

![Appointment of Directors

In the case of a banking company-

(a) no amendment of any provision relating to

1. The maximum permissible number of directors or

2. Appointment or re-appointment or termination of appointment or remuneration of a chairman,

3. Managing director or any other director, whole-time or otherwise] or of a manager or a chief executive officer

by whatever name called, whether that provision be contained in the company's memorandum or articles of

association, or in an agreement entered into by it, or in any resolution passed by the company in general meeting

or by its Board of directors shall have effect unless approved by the Reserve Bank;

4[(b) no appointment or re-appointment or termination of appointment of a chairman, a managing or whole-

time director, manager or chief executive officer by whatever name called, shall have effect unless such

appointment, re-appointment or termination of appointment is made with the previous approval of the

Reserve Bank

Any person appointed as Chairman, Director or chief executive officer or other officer or employee under this

section shall, -

(a) hold office during the pleasure of the Reserve Bank and subject thereto for a period not exceeding three

years or such further periods not exceeding three years at a time as the Reserve Bank may specify;](https://image.slidesharecdn.com/bankmanagement-classdiscussions1-240204134714-4101a677/85/Bank-Management-Class-discussions-1-pdf-25-320.jpg)

![Power of Reserve Bank to remove managerial and

other persons from office

Power of Reserve Bank to remove managerial and other persons from office

(1) Where the Reserve Bank is satisfied that in the public interest or for preventing the affairs of

a banking company being conducted in a manner detrimental to the interests of the depositors

or for securing the proper management of any banking company it is necessary so to do, the

Reserve Bank may, for reasons to be recorded in writing, by order, remove from office, with

effect from such date as may be

specified in the order, 1[any chairman, director,] chief executive officer (by whatever name

called) or other officer or employee of the banking company.](https://image.slidesharecdn.com/bankmanagement-classdiscussions1-240204134714-4101a677/85/Bank-Management-Class-discussions-1-pdf-26-320.jpg)

![Power of the Reserve Bank to give directions

(1) Where the Reserve Bank is satisfied that-

(a) in the public interest; or

(aa) in the interest of banking policy; or]

(b) to prevent the affairs of any banking company being conducted in a manner detrimental to the

interests of the depositors or in a manner prejudicial to the interests of the banking company; or

(c) to secure the proper management of any banking company generally,

it is necessary to issue directions to banking companies generally or to any banking company in

particular, it may, from time to time, issue such directions as it deems fit, and the banking companies

or the banking company, as the case may be, shall be bound to comply with such directions.

(2) The Reserve Bank may, on representation made to it or on its own motion, modify or cancel any

direction issued, and in so modifying or canceling any direction may impose such conditions as it

thinks fit, subject to which the modification or cancellation shall have effect.](https://image.slidesharecdn.com/bankmanagement-classdiscussions1-240204134714-4101a677/85/Bank-Management-Class-discussions-1-pdf-27-320.jpg)

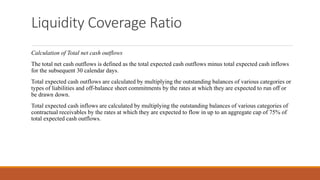

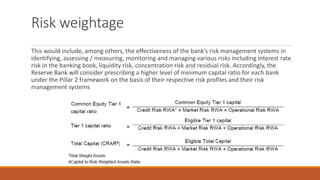

![Capital Adequacy Ratio

No. Regulatory Capital As % to RWAs

(i) Minimum Common Equity Tier 1 Ratio 5.5

(ii) Capital Conservation Buffer (comprised of Common Equity) 2.5

(iii) Minimum Common Equity Tier 1 Ratio plus

Capital Conservation Buffer [(i)+(ii)] – Total CET 8.0

(iv) Additional Tier 1 Capital 1.5

(v) Minimum Tier 1 Capital Ratio [(i) +(iv)] 7.0

(vi) Tier 2 Capital 2.0

(vii) Minimum Total Capital Ratio (MTC) [(v)+(vi)] 9.0

(viii) Minimum Total Capital Ratio plus Capital Conservation Buffer [(vii)+(ii)] 11.5](https://image.slidesharecdn.com/bankmanagement-classdiscussions1-240204134714-4101a677/85/Bank-Management-Class-discussions-1-pdf-78-320.jpg)

![Tier 2 Capital

Tier 2 Capital - Indian Banks

A. Elements of Tier 2 Capital

▪General Provisions and Loss Reserves

▪Debt Capital Instruments issued by the banks;

▪Preference Share Capital Instruments [Perpetual Cumulative Preference Shares (PCPS) /

Redeemable Non-Cumulative Preference Shares (RNCPS) / Redeemable Cumulative Preference

Shares (RCPS)] issued by the banks;

▪Stock surplus (share premium) resulting from the issue of instruments included in Tier 2 capital;](https://image.slidesharecdn.com/bankmanagement-classdiscussions1-240204134714-4101a677/85/Bank-Management-Class-discussions-1-pdf-88-320.jpg)