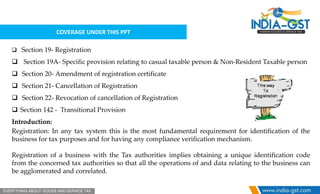

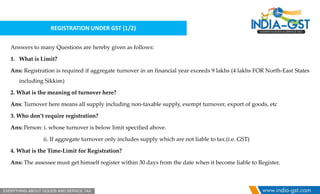

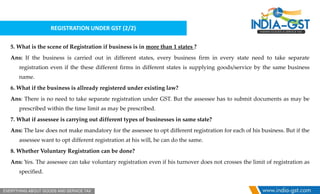

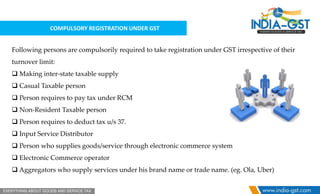

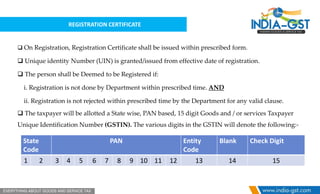

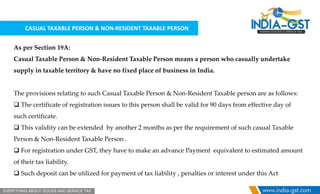

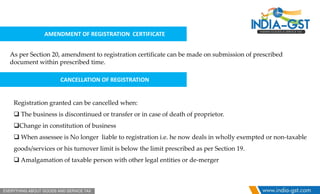

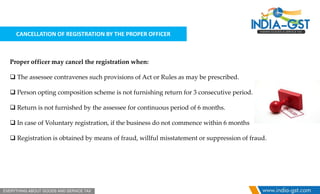

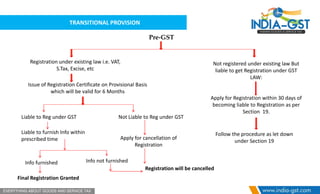

This document discusses registration requirements and procedures under the Goods and Services Tax (GST) in India. It covers key topics such as the registration limit, time limit for registration, separate registration requirements for businesses operating in multiple states, voluntary registration, and transitional provisions for businesses already registered under previous laws. The document also describes provisions for casual/non-resident taxpayers, amendment and cancellation of registration certificates, and circumstances under which the proper officer may cancel a registration.