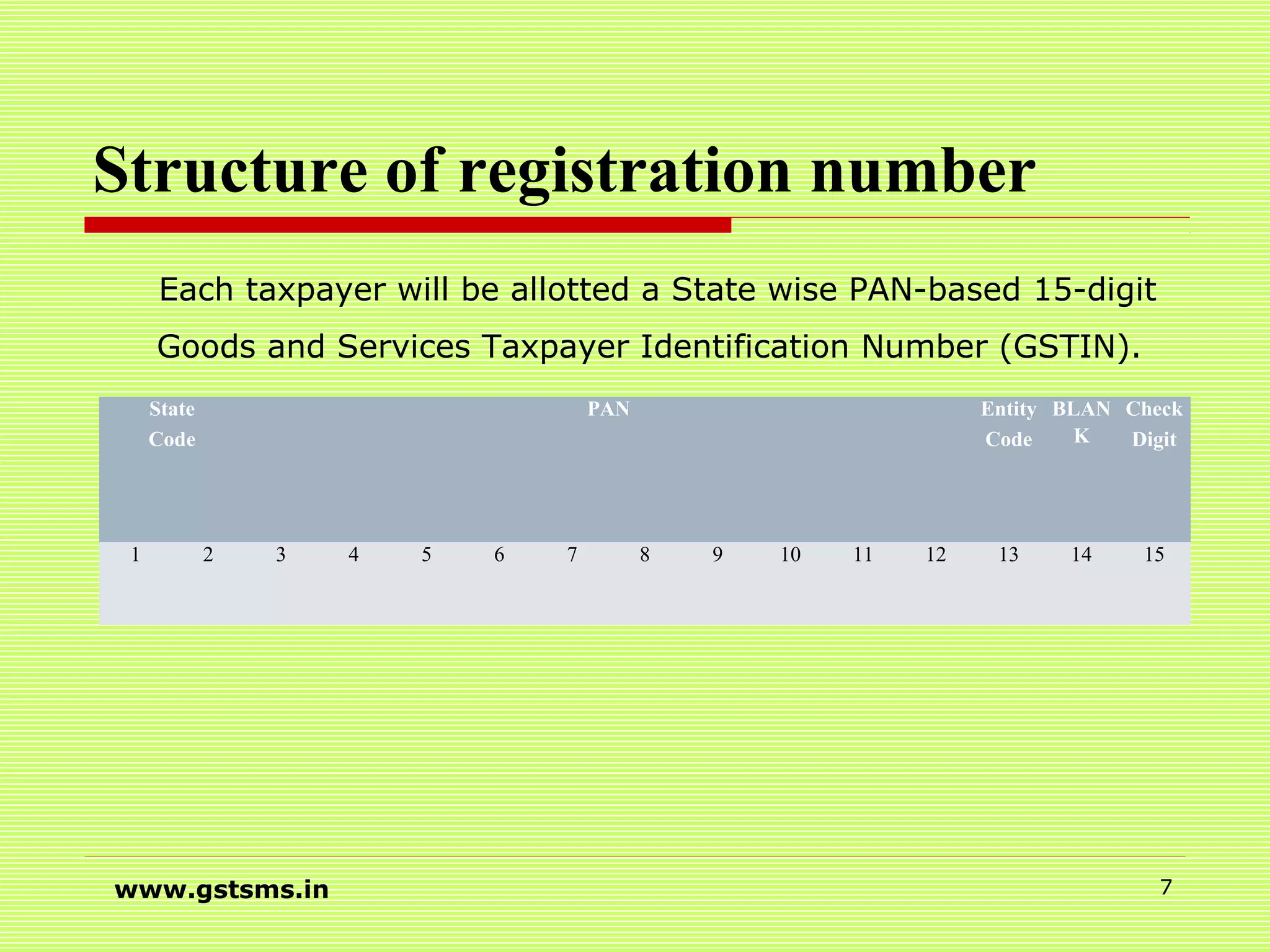

The document outlines the Goods and Services Tax (GST) registration process, detailing the eligibility criteria, application procedures, and the structure of the taxpayer identification number (GSTIN). It emphasizes the importance of timely application for input tax credit and provides guidelines for both new and existing applicants. This presentation was prepared by CA Rajat Mohan, who has significant expertise and contributions in the area of GST.