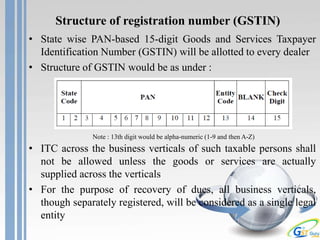

- Registration under GST is required for businesses with an annual turnover over the threshold limit, those making inter-state supplies, or those seeking input tax credits. Registration involves filing an application within 30 days to obtain a state-specific 15-digit GST identification number. Existing registrants will be migrated to the new system and provided with preliminary GSTINs based on available data.

![Registration application

• Application must be filed within 30 days from the date of

dealer’s liability for obtaining such registration

• Effective date of registration would be the date of application

i.e. whether the application has been filed within prescribed

time limit or otherwise

• The taxpayer would be eligible for ITC from the date of

application; if application filed within 30 days otherwise

from the date of registration

• Separate registration for each State

• Maximum 35 registration in each state [ 1-9 , A-Z]

• Separate registration for each sagment [ as defined in AS-17]](https://image.slidesharecdn.com/keynotesongstregistration-151229103406/85/Key-notes-on-gst-registration-3-320.jpg)

![Casual dealers

• A supplier who is not registered on regular basis

• Desires to conduct business in a State for a limited period

• Have to obtain registration in that State for that limited

period

• Shall not be allowed to opt for composition scheme

• Supplier would be eligible to claim ITC on purchases

• Period of registration would be mentioned in the registration

certificate

• Has to disclose estimated turnover over registration form

• Has to deposit estimated tax in form of two demand draft,

One for SGST and other for CGST [ Bank gurantee ]

• Which would be returned to the taxpayer after he has

discharged his final liability](https://image.slidesharecdn.com/keynotesongstregistration-151229103406/85/Key-notes-on-gst-registration-4-320.jpg)