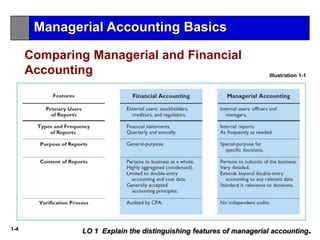

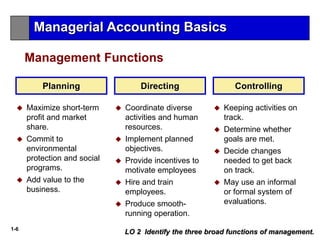

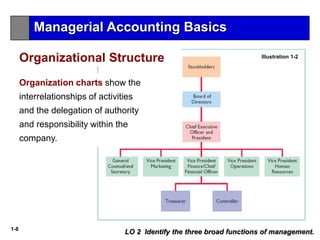

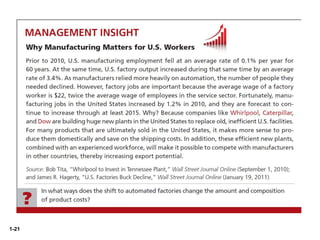

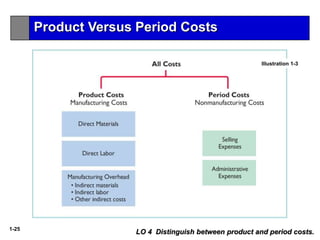

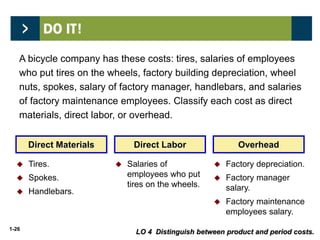

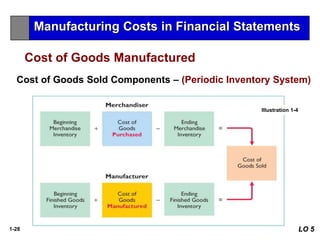

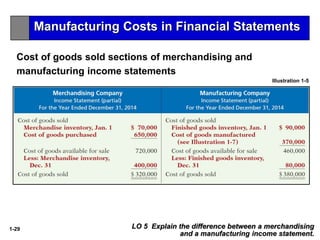

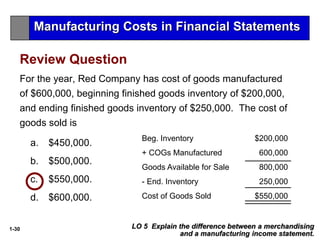

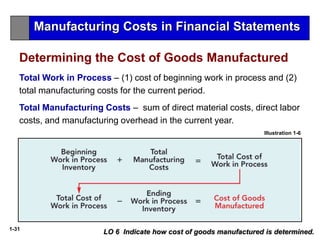

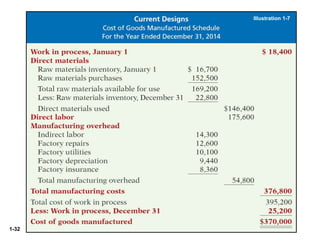

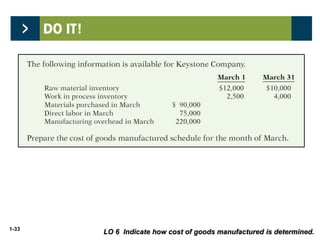

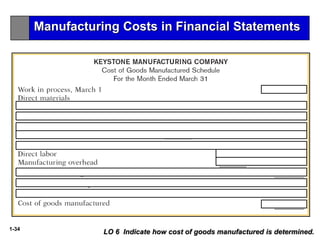

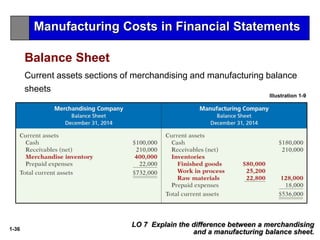

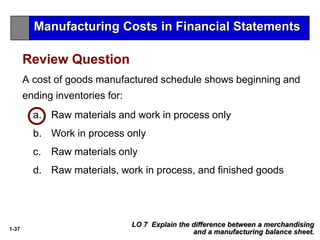

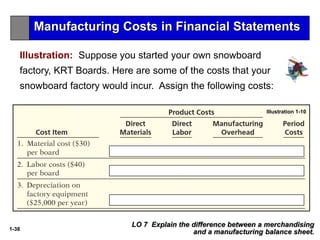

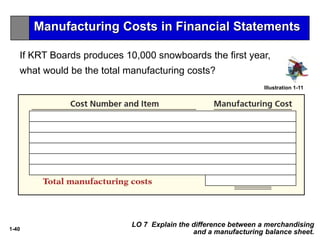

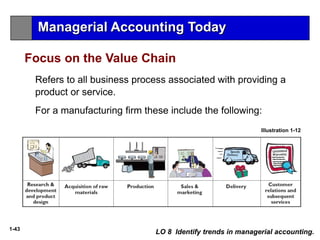

This document provides an overview of key concepts in managerial accounting. It begins by listing six learning objectives, including explaining distinguishing features of managerial accounting, identifying management's three broad functions, and defining manufacturing costs. It then discusses topics like the functions of management in planning, directing, and controlling; the three classes of manufacturing costs; and the differences between product and period costs. The document also summarizes how a manufacturing income statement differs from a merchandising statement and how the cost of goods manufactured is determined. Diagrams and examples are provided to illustrate key concepts.

![1-1

Chapter 1

Managerial

Accounting

Learning Objectives

After studying this chapter, you should be able to:

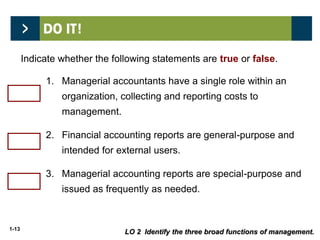

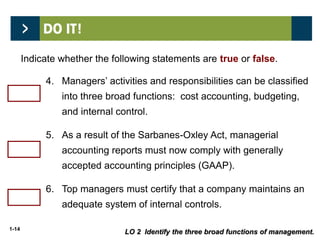

[1] Explain the distinguishing features of managerial accounting.

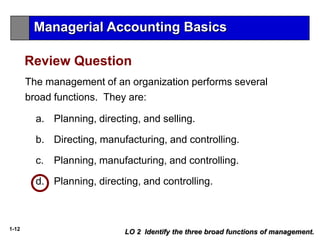

[2] Identify the three broad functions of management.

[3] Define the three classes of manufacturing costs.

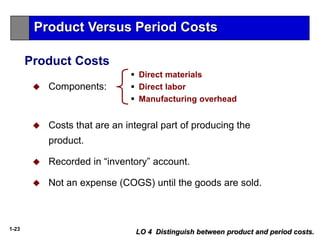

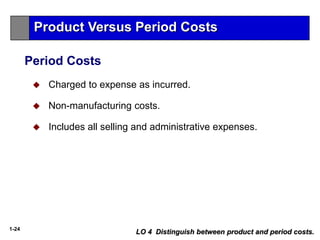

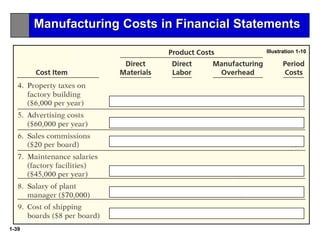

[4] Distinguish between product and period costs.

[5] Explain the difference between a merchandising and a manufacturing income

statement.

[6] Indicate how cost of goods manufactured is determined.](https://image.slidesharecdn.com/ch01-200915180032/85/Managerial-accounting-Ch01-1-320.jpg)