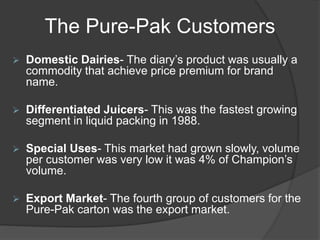

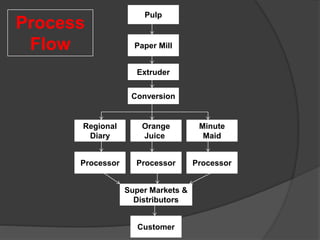

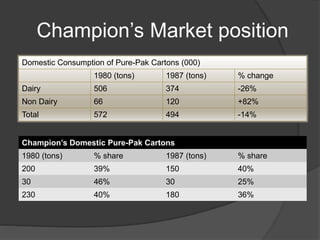

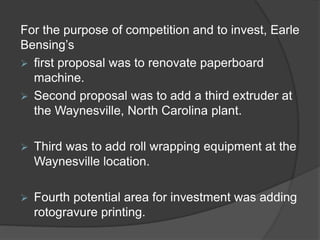

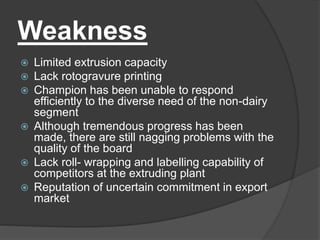

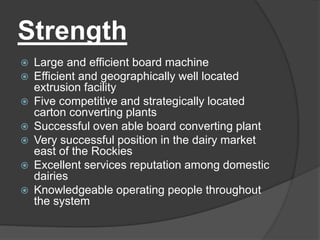

Champion International faces declining market share and an outdated manufacturing system while competitors have more advanced technology and capabilities. An analysis identifies opportunities in growing international and juice markets but also weaknesses in Champion's limited production capacity and quality issues. The VP must decide where to invest to improve operations, expand product offerings, and better position the company against competitors.