The document discusses competitor analysis and identifying competitors. It provides the following key points:

1. Competitor analysis is important for understanding competitive threats and opportunities. Japanese auto firms analyzed US competitors closely in the 1960s which helped them succeed.

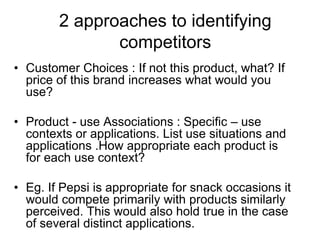

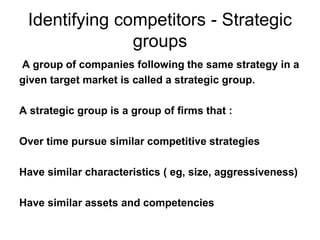

2. Competitors can be identified by looking at customer choices and product/use associations. Strategic groups of competitors following similar strategies can also be identified.

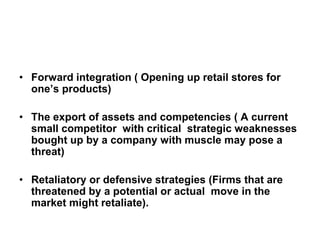

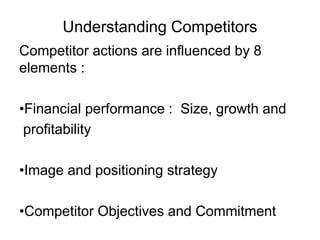

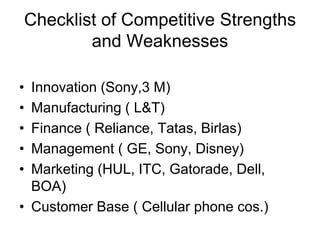

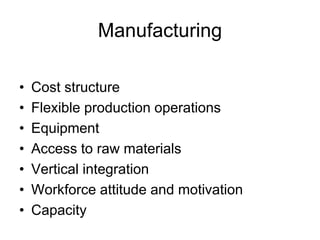

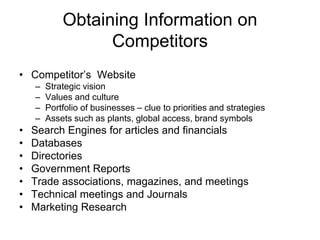

3. Potential competitors include market and product expansions or backward/forward integrations. Understanding competitors requires examining factors like objectives, strategies, strengths/weaknesses.

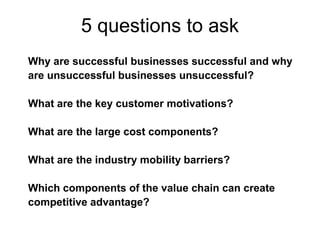

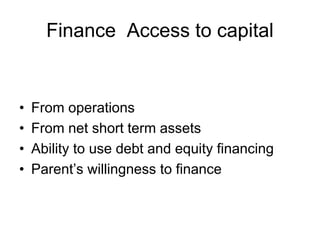

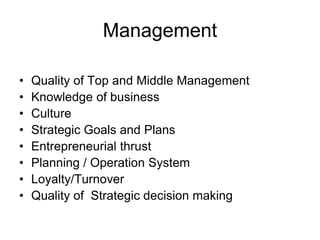

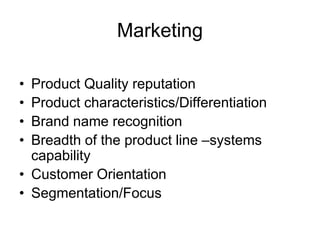

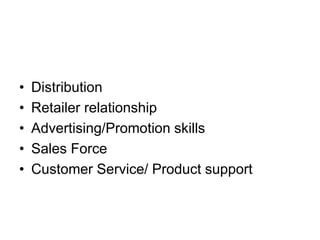

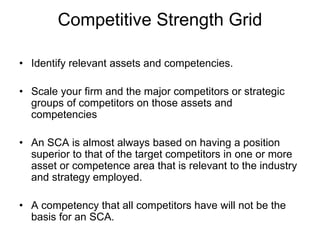

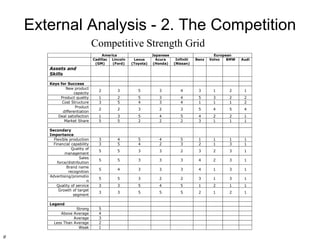

4. Competitor strengths and weaknesses are based on assets and can be identified by analyzing key customer motivations, costs, barriers to