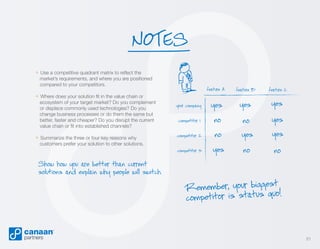

» How are you different?

» What are your competitive advantages?

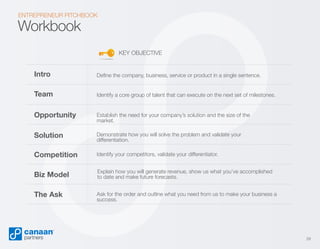

Key Objective:

Help us understand how you compare to alternatives and validate your differentiation.

20

�NOTES

» Identify direct and indirect competitors.

» Outline competitive landscape - who are the key players, their strengths/weaknesses, funding status.

» Position yourself relative to competitors - where do you play?

» Clearly articulate your differentiation and competitive advantages.

» Address any perceived weaknesses head-on.

» Cite third party reports, analyst coverage to validate your claims about the competitive landscape and

your position within it.

» Discuss barriers to entry for potential new competitors.

- What are