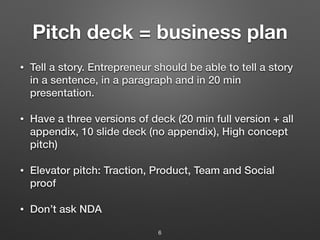

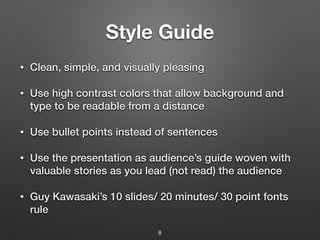

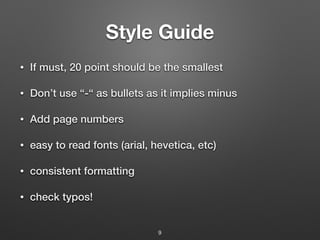

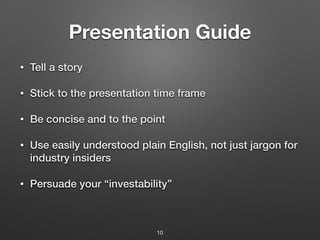

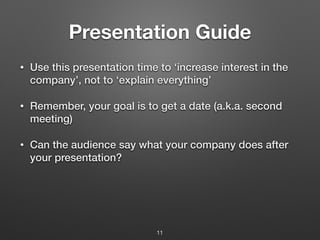

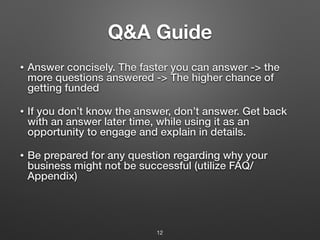

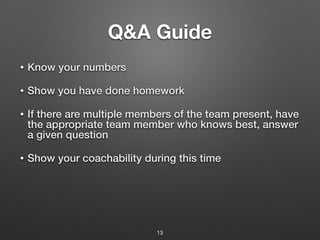

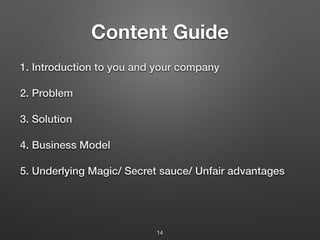

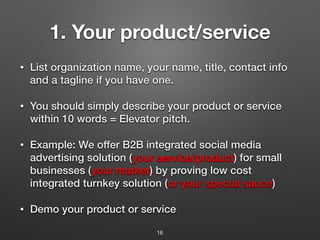

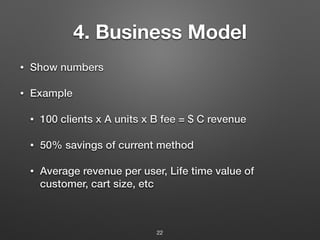

This document is a guide for creating an effective pitch deck aimed at attracting investors. It emphasizes storytelling, concise delivery, and the importance of visuals while outlining the essential content structure including problem-solution and financial projections. The guide also details how to handle Q&A sessions and stresses the need for thorough preparation and follow-up to secure further meetings.