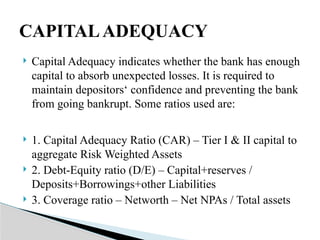

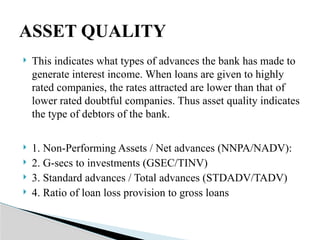

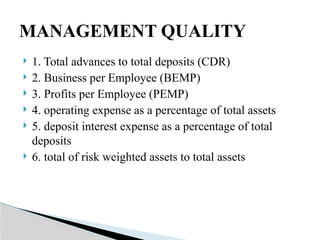

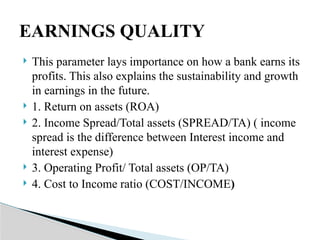

The document discusses key ratios used in bank ratio analysis, focusing on capital adequacy, asset quality, management quality, earnings quality, and liquidity. It outlines various metrics for each category, such as the capital adequacy ratio, non-performing assets, return on assets, and liquidity measures. The analysis aims to assess the bank's ability to absorb losses, manage assets, sustain earnings, and maintain proper liquidity.