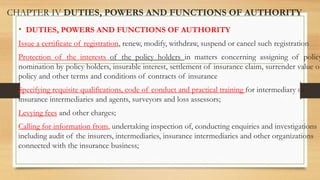

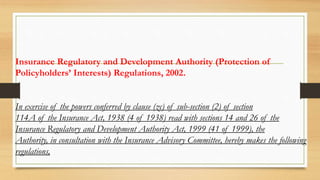

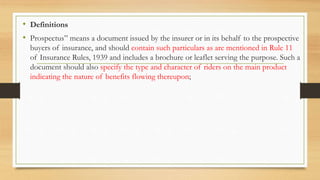

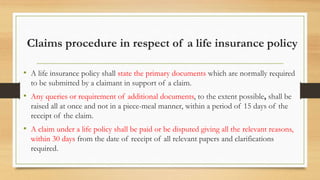

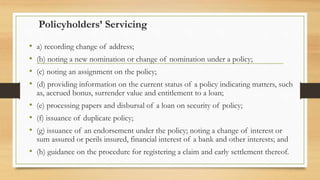

The Insurance Regulatory and Development Authority of India Act, 1999 establishes the regulatory framework for the insurance sector in India, outlining the powers, functions, and duties of the Insurance Regulatory and Development Authority (IRDA). It includes provisions for the registration and regulation of insurers and intermediaries, the protection of policyholders' interests, financial governance, and grievance redressal procedures. The act also mandates the establishment of specific regulations to ensure the effective execution of insurance policies and the management of claims procedures.