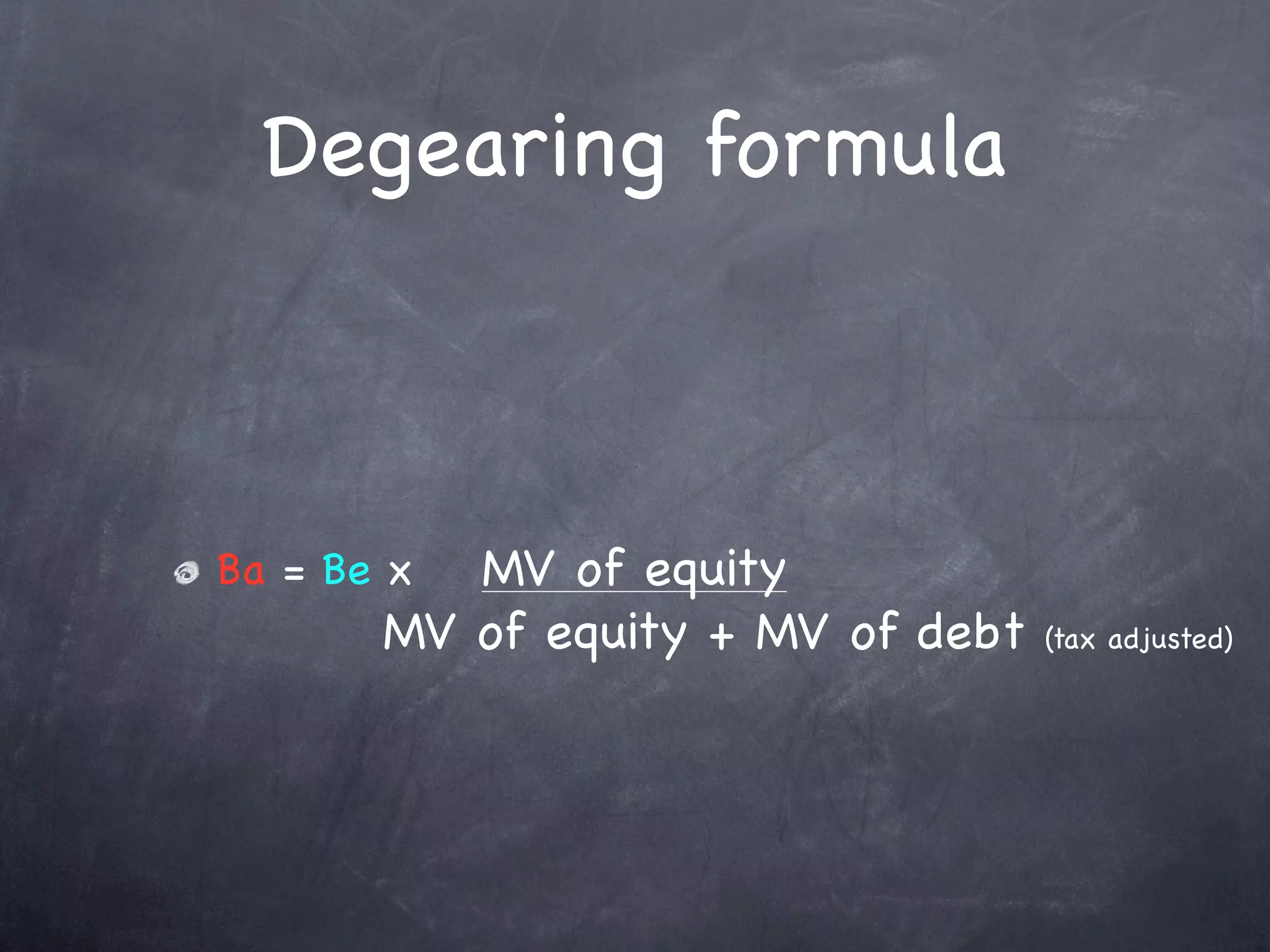

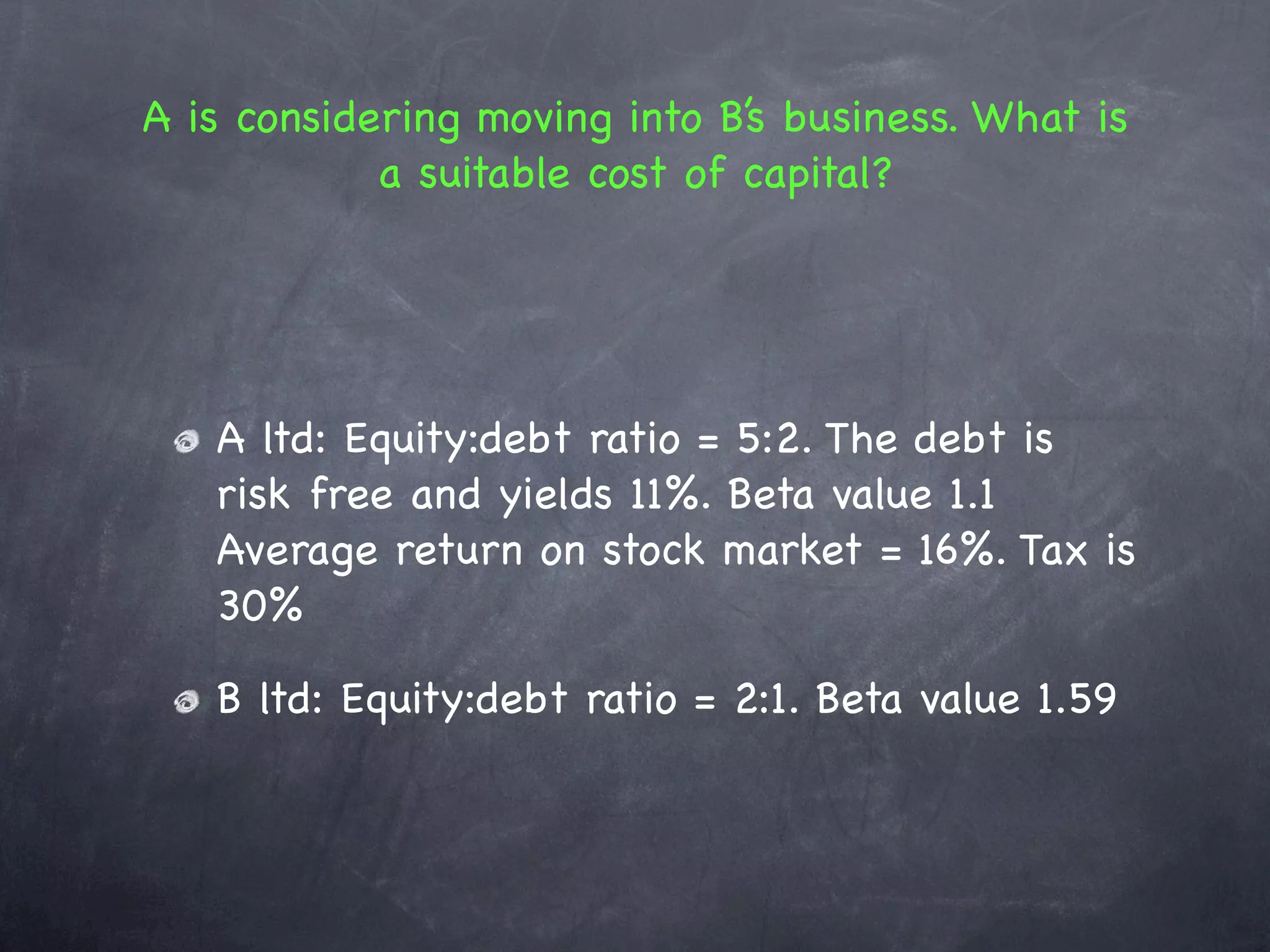

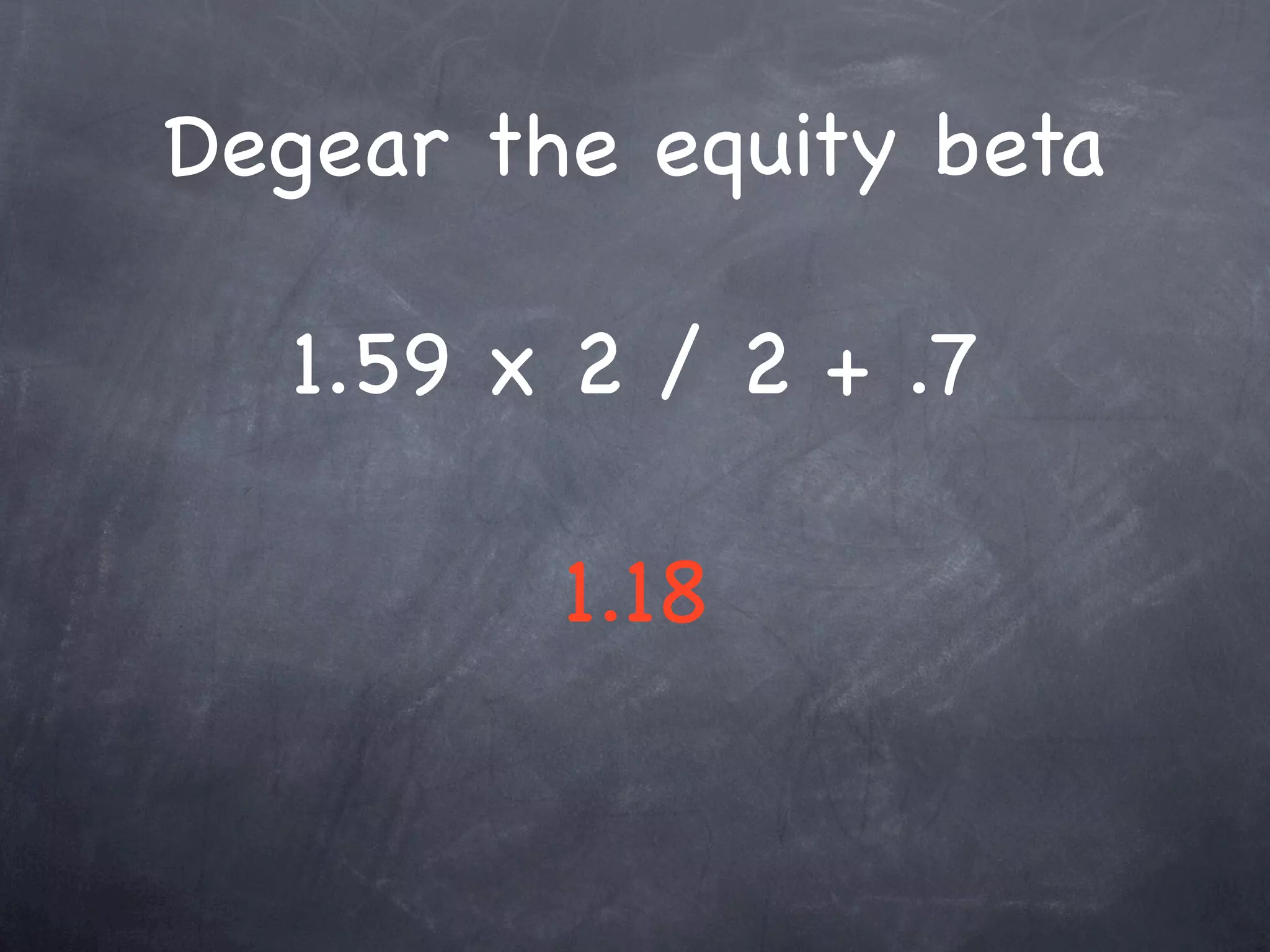

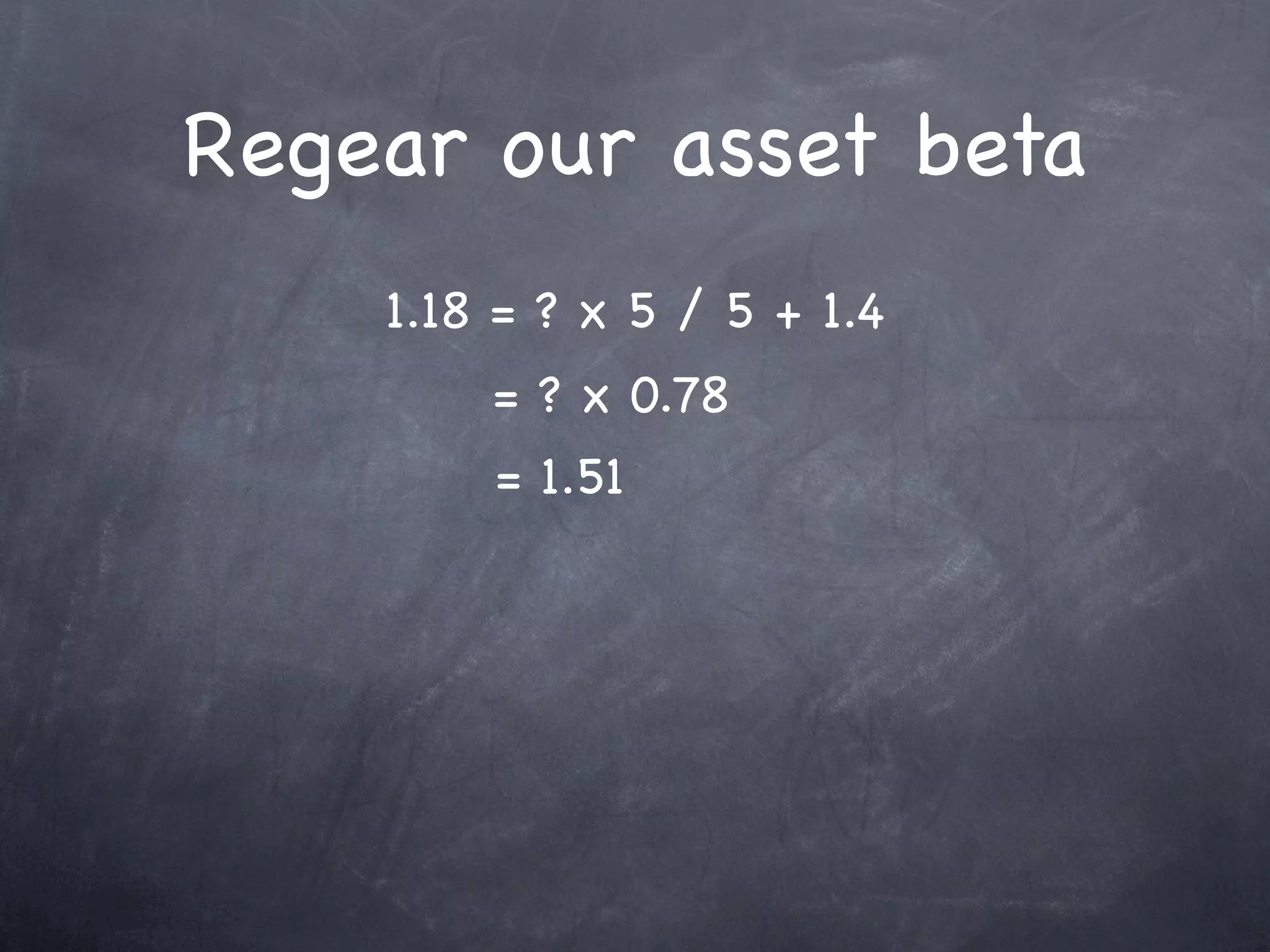

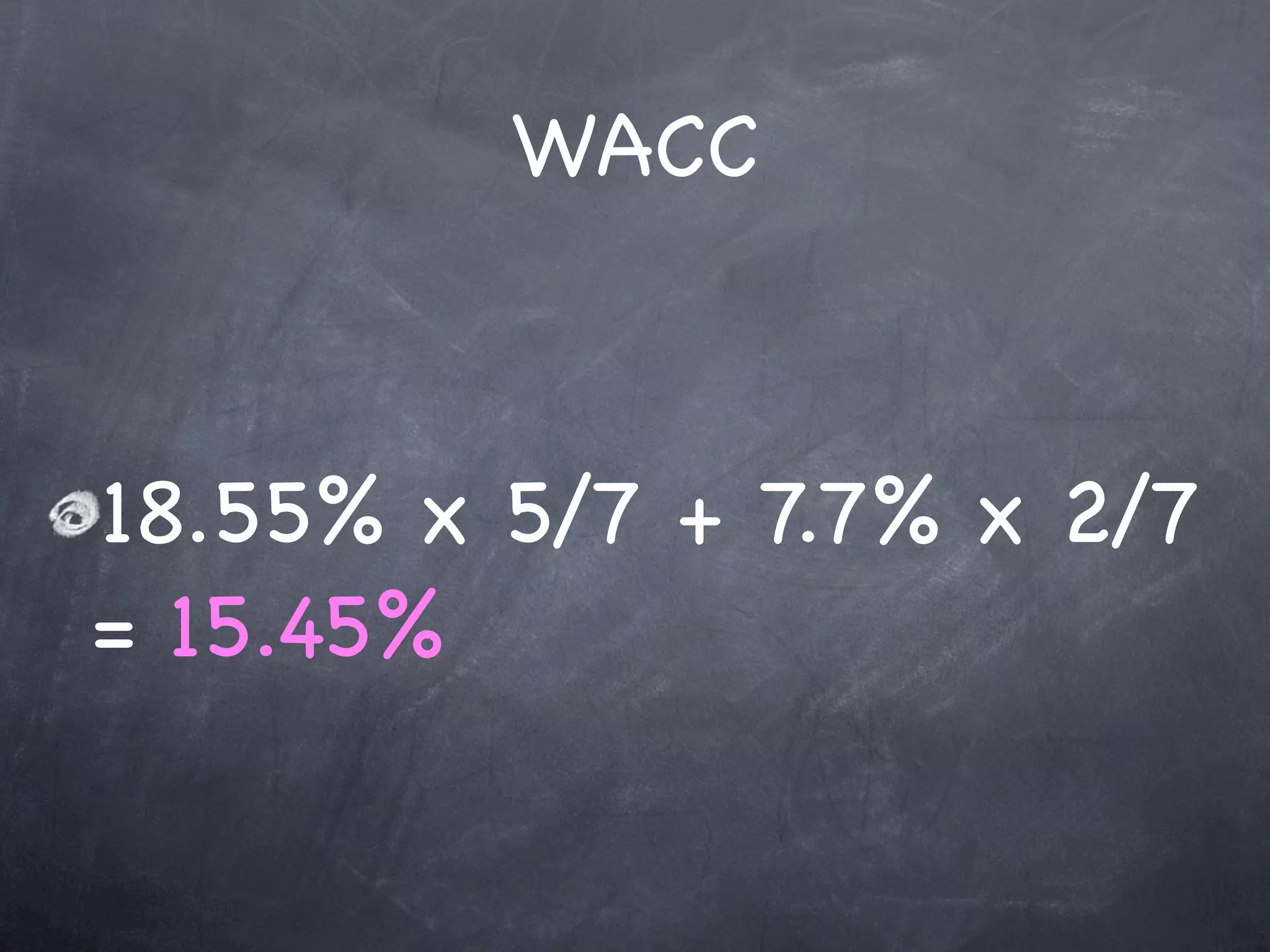

The document discusses capital structure and cost of capital. It explains that changing a company's gearing (debt to equity ratio) can impact its weighted average cost of capital (WACC) and shareholder wealth. The traditional theory is that WACC has a U-shaped relationship with gearing, with the optimal point at the bottom of the U. Modigliani-Miller theory suggests that with no taxes, gearing is irrelevant as debt and equity costs offset, but with taxes, higher gearing lowers WACC. Betas measure risk, with asset beta measuring business risk and equity beta measuring both business and financial risk from debt. An appropriate cost of capital can be calculated by degearing and regearing