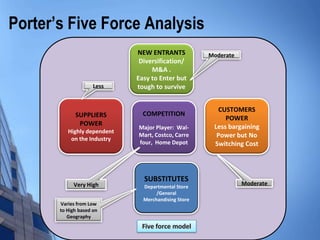

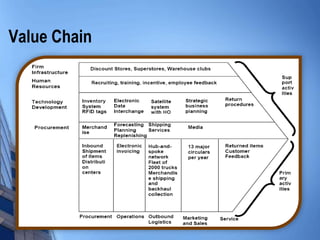

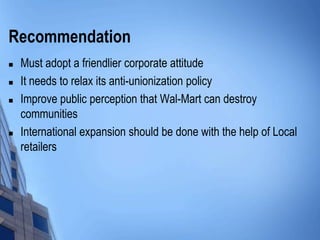

Wal-Mart is the largest retailer globally with $405.6 billion in revenue. It has a powerful brand and large scale of operations worldwide. However, it faces weaknesses such as self-cannibalization and legal issues. Its strategies include strategic business programs, efficient working capital management, and expanding online sales. Wal-Mart has a sustainable advantage through its size, discounts, distribution network, and IT infrastructure. It is recommended that Wal-Mart improve its public perception and expand internationally with local retailers.