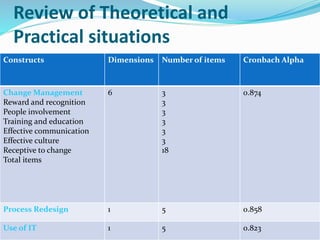

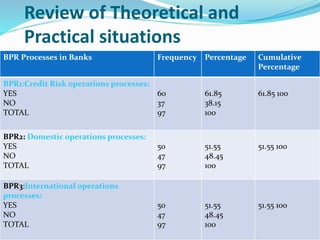

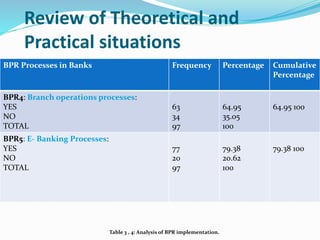

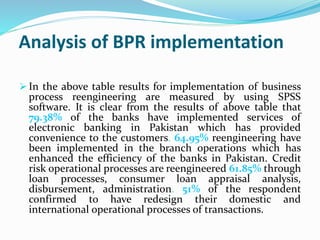

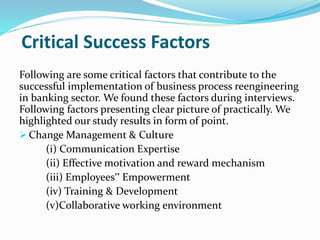

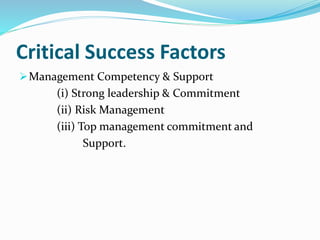

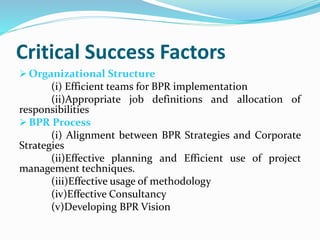

This document explores the impact of Business Process Reengineering (BPR) on the performance of banks in Pakistan, emphasizing the necessity for banks to adapt their operations to meet growing customer demands for quality and efficiency. The study highlights that successful BPR implementation significantly improves organizational performance through enhanced service delivery and customer satisfaction. Key findings identify critical success factors such as effective change management, IT capabilities, and alignment with corporate strategies as essential for successful BPR execution.